The December’s highs of (0.7215) and an interim retracement in the 0.7240-50 area still attract but the push above 0.7200 is not accelerating. A slip now below 0.7180 could trigger a flush back to 0.7075-90.

NZD/USD medium term perspectives: Slide up to 0.68 levels cannot be disregarded. The US dollar has had a remarkable bounce since the US polls and has potential to rise further in the months to come. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

We expect NZD to fall through this year, reaching 0.62 at year-end. The support to growth from migration will fade, while the RBNZ at the least are likely to hold rates steady as inflation normalizes, pushing real rates materially lower we think.

The economy is also subject to credit tightening through numerous channels: macro-prudential constraints, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. This creates the space-or the need-for the OCR to fall and drag NZD with it while preserving monetary conditions.

OTC outlook and hedging framework:

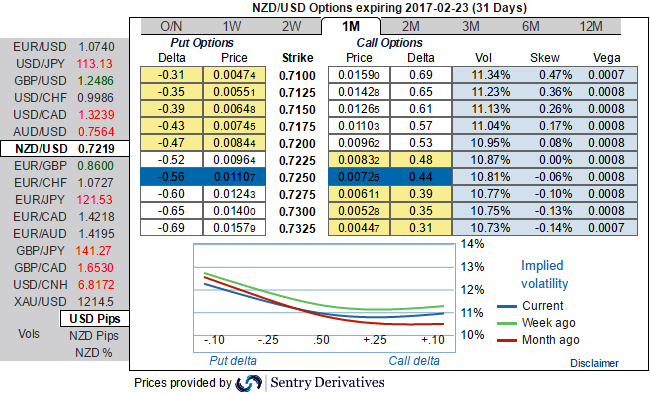

Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially after data showed that China’s imports dropped far more than expected last month and as the greenback remained supported by Hawkish US central bank’s tone. You could notice OTC market discounting these factors in 1m IV skews (they bid for OTM put strikes).

Well, to mitigate the further bearish risks, at spot reference 0.7218 we reckon the NZDUSD options strips with narrowed strikes.

Hence, we advocate longs in 2 lots of 2m -0.49 delta put options, while buying 1 lot of +0.51 delta calls of 2w expiry.

Even if the underlying spot goes against our anticipation, the underlying risk is properly mitigated regardless of swings, the strategy could also be utilized on speculating grounds as it is likely to fetch certain yields regardless of trend.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different