OTC Outlook and Option Strategies:

Please be noted that the ATM call of 1w expiries are trading 23% more than of its NPV, while implied volatilities of 1w tenors are just shy above 9% and sliding below 8.5% for 1m tenors. Hence, this is perceived as the disparity between IVs and option pricing.

If you are short on an option, IV should shrink away. A writer of an option wishes IV to drop so the premium also should drop accordingly. Please be noted that the short-dated options are less sensitive to IV than long tenured options.

Well, all the prevailing macro standpoints could propel GBPAUD either on upswings or downswings.

Ever since GBPAUD has dropped from the peaks of 2.2397 levels, in the prevailing puzzled environment you could observe that the momentary bulls of this pair struggle to retrace above 38.2% Fibonacci retracements from the lows of and sustain above this level, currently in a consolidation phase trading below EMAs to signal some bearish pressures.

Thus, we advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

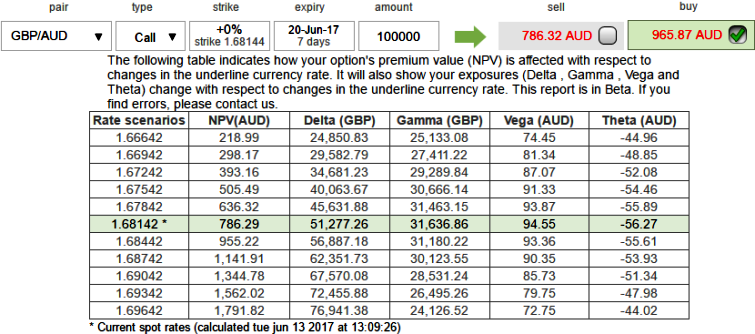

The execution: Initiate long in GBPAUD 1M at the money vega put, long 1M at the money vega call and simultaneously, Short 2w (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 1w IVs are just shy above 9%, whereas ATM calls are overpriced 23% more than NPV, hence, we foresee theta would favor due to time decay while writing such exorbitant calls as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation