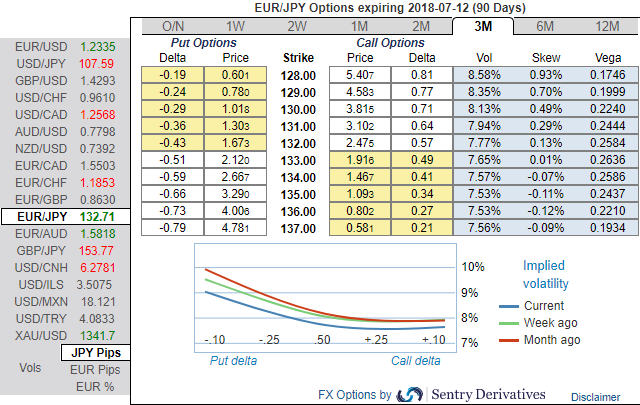

The neutral-negative risk reversal numbers are still indicating hedging sentiments for the potential bearish risks across all tenors remain intact, while positively skewed IVs of the 3m tenor also signifies the hedgers’ interests in OTM put strikes.

These skews signal underlying spot FX to drop below 128 levels. While glance through above nutshell evidencing risk reversals, although these numbers have been bearish neutral for longer tenor but bearish risk sentiment remain intact on any negative fundamental driving forces, to substantiate this stance we can observe the 2nd highest hedging sentiments for bearish risks of this pair among G10 FX space after USDJPY.

Well, to substantiate this standpoint, if you observe the technical chart of this pair, the major trend was rising higher upto 61.8% Fibonacci levels from the lows of 109.205 levels but couldn’t sustain these level, while bearish pattern candles such as hanging man and gravestone doji pop up to signal weakness as leading oscillators indicate struggling momentum. The momentum indicators have been substantiating selling pressures in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.

Options strategies for hedging:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 46 levels (which is bullish), while hourly JPY spot index was at -158 (highly bearish) while articulating at 08:40 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate