- USD/JPY closed overnight's trade below 113 handle after Dollar-Bearish comments from US President Donald Trump.

- Trump voiced dissatisfaction with the current pace of Fed rate hikes and strongly hinted that he would prefer a slower and lower creep-up of interest rates.

- The pair hit session lows of 112.06, but quickly pared losses as markets realised the Fed was independent of White House administration.

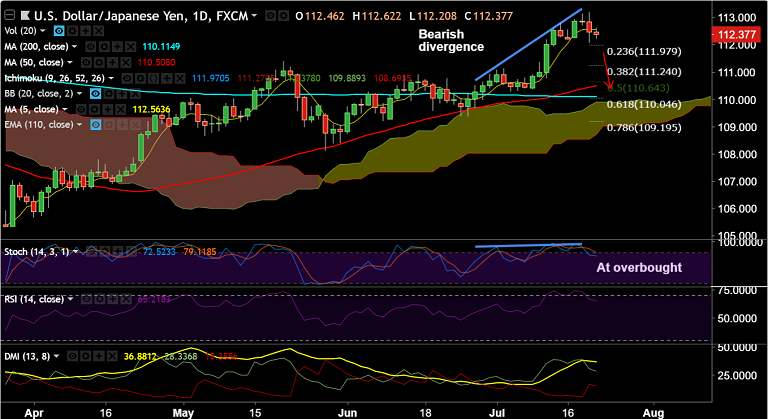

- That said, we see bearish divergence on momentum indicators and also overbought conditions which could see a short-term correction.

- The pair has been on an uptrend since March 2018 lows of 104.62 and is on verge of closing the week with a shooting star.

- The pair is holding support at 112.17 (4H 55-EMA) on the intraday charts, break below will see weakness. Scope then for test of 20-DMA at 111.28.

- 200W SMA at 113.24 is major resistance and we see further upside only on break above.

Support levels - 112.17 (4H 55-EMA), 111.97 (23.6% Fib), 111.28 (20-DMA)

Resistance levels - 112.56 (5-DMA), 113, 113.24 (200W SMA)