- EUR/JPY faces major resistance at 124 levels which is converged trendlines.

- The pair was rejected at highs on Thursday's trade, we see spinning top formation at highs on daily charts.

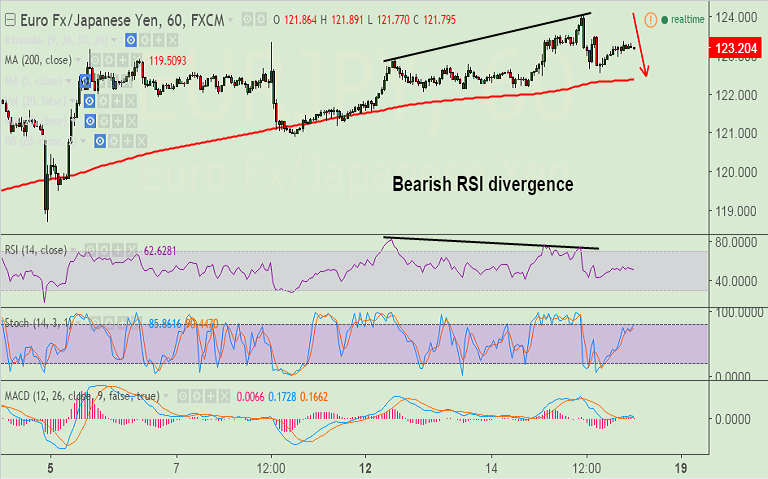

- Hourly charts have shown bearish RSI divergence, raising scope for downside.

- Breakout above 124 could see test of 125.13 (50% Fib of 141.055 to 109.205 fall).

- On an intraday basis, we see scope for test of 1H 200-MA at 122.37, violation there could see test of 121.37 levels.

- Support levels - 122.85 (5-DMA), 122.37 (1H 200-MA), 122, 121.37 (38.2% Fib)

- Resistance levels - 123.38 (session high), 124, 124.64 (Dec 5 high)

Recommendation: Good to sell rallies around 123.40, SL: 124, TP: 122.85/ 122.40

FxWirePro's Hourly EUR Spot Index was at 9.92715 (Neutral), while Hourly JPY Spot Index was at -73.8145 (Bearish) at 0615 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.