Bearish CADJPY scenarios:

1) NAFTA withdrawal;

2) Canadian growth slowdown extends vis-à-vis US;

3) Local/global crude oil prices weaken despite cutbacks

4) Geopolitical crisis worsens

5) The global investors’ risk aversion heightens significantly,

6) The US starts vehemently criticizing Japan’s trade surplus against the US

7) Japan's economy further decelerates and speculations for the BoJ’s additional easing grows.

Bullish CADJPY scenarios:

1) USMCA ratified ahead of schedule;

2) BoC reverts to hawkish rate path;

3) A broad US dollar discount returns because of political risks

4) The acceleration in US inflation leads to aggressive Fed hikes and a spike in UST yields

5) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

Most importantly, central banks in both regions are lined up for their monetary policies, BoC on 29th May and BoJ on 20th June. Moreover, BoJ Governor Kuroda’s upcoming speech is likely to give some hints.

Last month, the Bank of Canada formally eliminated its rate hiking bias. This sets the stage for a range of risks from trade to crude oil to feature more prominently this year.

Contemplating all above factors, although it is sensed that all chances of CAD may look superior over Japanese Yen in the near-term future; we advise balanced-hedging perspective but to favor slightly CAD’s appreciation in near-terms through below recommendations.

OTC Updates and Options Trading Strategy (CADJPY):

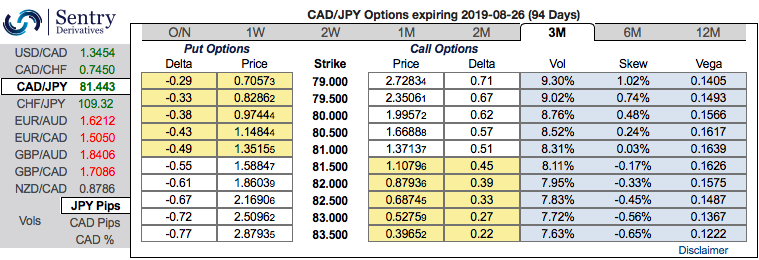

Positively skewed CADJPY IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 79 levels indicating downside risks in the medium terms (refer 1stchart). Please observe above technical chart for the major downtrend.

Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of a customized version of options combination and more bearish version of the common straddle.

Huge profits achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -116 levels (which is highly bearish), hourly JPY spot index was at 82 (bullish) while articulating at (09:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation