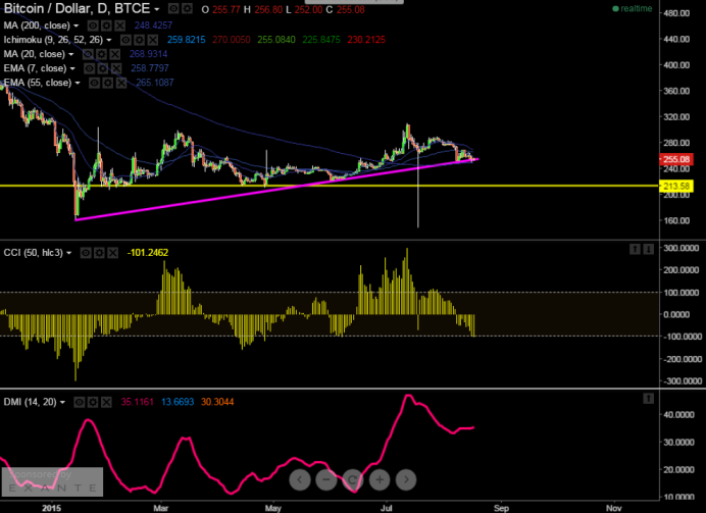

- BTC/USD has made a low of $250 and slightly recovered from that level. It is currently trading at $256. Short term trend is bullish as long as support $247 holds.

- The major support is around $247 (200 day MA) and break below will drag the pair further down till $232/$220.

- The pair's minor resistance is around $266 and any break above would extend gains till $276/$290.

Indicator (Daily chart)

CCI (50) -Sell

Ichimoku- Sell

We prefer to buy at dips around $255 with stop around $247 for the target of $275/$286.