With Brexit negotiations currently deadlocked, European leaders are scheduled to meet in Brussels today aimed at breaking the current impasse. PM May will brief EU leaders on her current Brexit position this evening, where she is expected to provide a potential solution to the Irish border, ahead of a summit dinner for the remaining 27 leaders.

With just five and a half months before the planned Brexit date of 30 March 2019 and an agreement providing for the UK’s orderly exit from the European Union (EU) yet to be reached, EU/UK official talks on a withdrawal agreement in accordance with Article 50 of the EU Treaty, have gained pace. Not long ago, EU Brexit Commissioner Michel Barnier stated that it is “realistic” to expect a withdrawal agreement (i.e. a deal on the first phase of Brexit negotiations) by mid-November. Admittedly, out of the five priority issues necessary for a withdrawal agreement, three have already been settled: EU citizens’ rights, UK financial commitments and the 21-month status quo transition period after the UK’s exit to allow time for consumers, businesses and public bodies to adjust to changes in the rules governing their operation as a result of leaving the EU.

However, the remaining two issues are, undoubtedly, the most controversial ones:

i) avoiding a hard border between Northern Ireland (part of the UK) and the Republic of Ireland (member of the EU) so as to abide by the 1999 Good Friday peace agreement; and

ii) the framework of the future (i.e. post-Brexit) EU/UK relationship. In line with Article 50 of the EU Treaty which sets in motion the process for a country’s exit from the EU, a withdrawal agreement should be concluded “setting out the arrangements for its (the member state’s) withdrawal, taking account of the framework for its future relationship with the Union”.

A deal that will cover both the UK’s separation issues from the EU and the framework of the long-term EU/UK relationship —according to the decision reached at the 22/23 March EU Summit — would pave the way for the UK to enter the transition period giving the government time to come in full agreement with the EU on the principles governing the future EU/UK relationship. This is in line with Article 50 of the EU Treaty, which sets out explicitly that such an agreement is a prerequisite for Brexit talks to proceed to the second (and final) phase related to the terms of the future EU/UK relationship. It is worth noting that an agreement on the framework for the future EU/UK relationship is not equivalent to an actual trade deal, i.e. a deal on the principles governing the future EU/UK relationship.

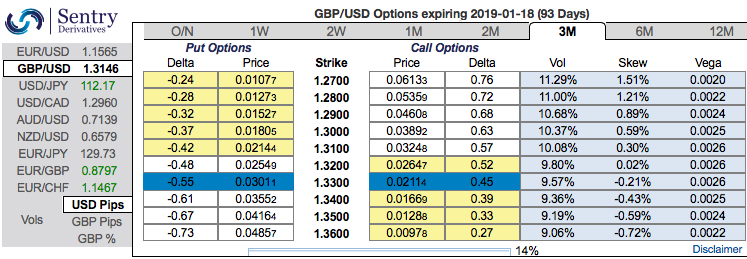

OTC outlook: Positively skewed implied volatilities still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been bearish neutral, no change is observed.

The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike. Courtesy: Eurobank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -48 levels (which is bearish), hourly USD spot index has shown bullish numbers at 59 (bullish), while articulating (at 10:14 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics