EURAUD uptrend has been edgy and kind of stuck in a range, the swings are oscillating between 1.6191 and 1.5620 levels with some sort of bearish indications.

The Aussie’s weakest point last week came in the day following the federal budget but the two seem unrelated. The RBA is likely to have expected the tax cuts and infrastructure spending announcements in the budget so will remain upbeat on growth. It is notable, however, that both the RBA and budget baseline forecasts assume that wages growth has bottomed and will accelerate this year and the next, despite a slowdown in job creation.

Event risks: RBA May Board meeting minutes, Deputy Governor Debelle speaks, China Apr industrial production and retail sales, Germany ZEW May investor sentiment, UK Mar unemployment, US Apr retail sales, May NY Fed Empire State business survey (Tue), Aust Westpac-MI May consumer sentiment, Aust Q1 wage cost index, Japan Q1 GDP, Bank of Thailand policy decision, US Apr housing starts (Wed), Aust Apr employment, New Zealand 2018/19 budget, Bank Indonesia policy decision (Thu), Japan Apr CPI, Canada Apr CPI (Fri). Fed officials speak throughout the week.

In order to take advantage of vol/correlation setup, one could play directionally stronger reserve currency vs. weaker high beta (vs. the USD) via worst-of options. Rich correlations and still generally depressed vols (especially in EUR crosses) map into the favorable pricing of worst-of options for EURUSD vs. AUDUSD that are priced near the multi-year lows in premium (refer above chart).

Moreover, even absent trade skirmishes, the anticipated direction of the two currencies is in line with our analysts’ view of EUR outperformance this year as ECB moves towards policy normalization and antipodean central banks staying on hold in the face of structural headwinds.

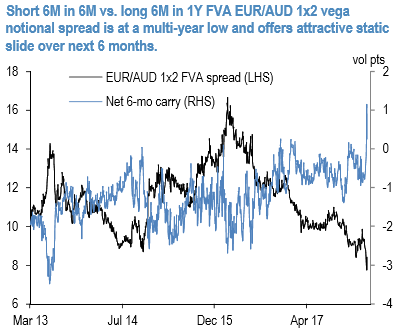

Long vega hedge via cheap FVA spreads: 1x2 forward volatility (FVA) spreads utilize favorable vol slide along term structures and are passage-of-time friendly, low maintenance long vega positions.

The basic construct involves selling a shorter dated FVA along the upward sloping segment of the vol curve to partially fund the purchase of a longer dated FVA along a flatter part of the term structure.

The roll-down of the short leg compensates (or even eliminates) the slide of the long position while preserving the overall net long vol exposure of the structure.

Historically P/L on this type of structures closely coincided with bounces in the spread pricing (refer above chart).

In the case of EUR/Antipodean crosses, current entry levels near pre-GFC lows are a bargain by historical standards (refer above chart), while the net 6 months static vol slide at forward start of the short leg is substantially positive (+1vol), making the long/short structure superior to holding a similar expiry straddle. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?