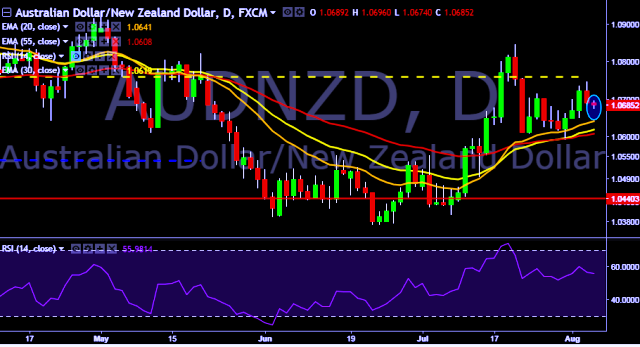

- AUD/NZD is currently trading around 1.0690 marks.

- Pair made intraday high at 1.0695 and low at 1.0673 marks.

- Intraday bias remains neutral till the time pair holds key resistance at 1.0747 marks.

- A daily close below 1.0689 will take the parity down towards key supports around 1.0649, 1.0590, 1.0443, 1.0371, 1.0326 and 1.0237 marks respectively.

- On the other side, a sustained close above 1.0689 will drag the parity higher towards key resistances at 1.0747/1.0865/1.0912/1.0966/1.1062/1.1148 levels respectively.

- Australia June retail sales m/m decrease to 0.3 % (forecast 0.2 %) vs previous 0.6 %.

- RBA says recent rise in A$ has had modest dampening e

- RBA says further rise in A$ would lower economic growth, inflation.

- RBA trims GDP forecast for December 2017 to 2-3 pct, December 2018 unchanged at 2.75-3.75 pct, 2019 raised to 3-4 pct.

- RBA sees unemployment little under 5.5 pct by end 2019, recent jobs data provides more confidence.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest