Despite the momentary rebound during New Year eve, AUDUSD is lower than when we published our 2019 Outlook, and we continue to expect modest depreciation to 0.68 by end of H1-2019. JPM forecasts assume that global growth will remain slightly above trend into 2019. And while China’s growth has down-shifted another gear, this has occurred mostly through the trade channel, with stabilization in FAI and shuttering of domestic commodity production proving supportive for global iron ore and coal prices.

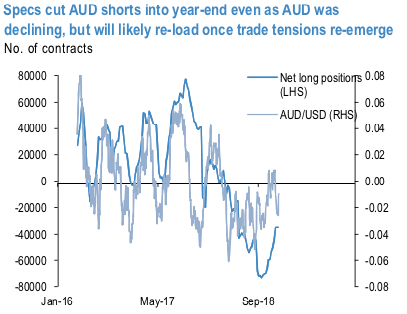

Speculative positioning in AUD turned less negative into the end of 2018 (refer 1stchart). This ran contrary to the price action, suggesting that motivated clearing of dealer longs into year-end was another important drag on AUD. If our macro view is right, the reprieve from the China-US trade spat will prove temporary, with re-engagement later in the year on IP protection forcing another round of tariffs. This should see a short positioning increase again.

The central policy question in the near-term is whether the RBA will abandon their (softly-held) tightening bias. RBA guidance has long suggested the next move in rates is likely up. But a much weaker housing market (refer 2nd chart) and softer GDP growth have seen officials waver on this message of late.

The Board’s guidance to shift to an on-hold outlook in the next minutes in mid-February, that would be the green light for pricing of rate cuts this year. We do not expect the RBA to fully abandon the eventual rate hike message but were that to happen, it would clearly help the argument that rate spreads will overpower positive terms of trade backdrop for AUD.

Hedging Perspectives (AUDUSD):

Let’s just quickly glance through OTC outlook of AUDUSD, before deep diving further into the strategic framework.

Please be noted that the positively skewed IV of 3m tenors signify the hedgers’ interest to bid OTM put strike up to 0.69 levels which is in line with the above bearish scenarios (refer 1stnutshell).

While mounting numbers of bearish risk reversals and bearish neutral RRs of the 3-6m tenors that are also in sync with the bearish scenarios refer 2nd(RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risk projections. Courtesy: Sentrix, JPM & Saxo bank

Currency Strength Index: FxWirePro's hourly AUD spot index has shown -65 (bearish), while USD is at 6 (neutral) while articulating at 12:53 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes