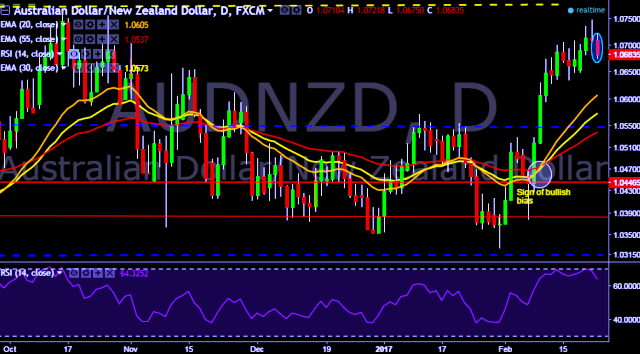

- AUD/NZD is currently trading around 1.0673 marks.

- Pair made intraday high at 1.0721 and low at 1.0673 marks.

- Intraday bias remains bearish till the time pair holds immediate resistance at 1.0748 marks.

- A daily close below 1.0710 will take the parity down towards key supports around 1.0648, 1.0594, 1.0552, 1.0516, 1.0460, 1.0412, 1.0370, 1.0326, 1.0237, 1.0184, 1.0109 and 1.0053 marks respectively.

- On the other side, a sustained close above 1.0710 will drag the parity higher towards key resistances at 1.0735/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA) levels respectively.

- Australia’s Q4 capital expenditure increases to -2.1 % (forecast -0.4 %) vs previous -3.3 % (revised from -4 %).

- Australia’s Q4 building capex decreases to -4.1 % vs previous -3.6 % (revised from -5.7 %).

- Australia’s Q4 plant/machinery capex increases to 0.4 % vs previous -3 % (revised from -1.9 %).

FxWirePro: Aussie falls against major peers as Australia’s private capital expenditure data fails to meet expectations

Thursday, February 23, 2017 1:08 AM UTC

Editor's Picks

- Market Data

Most Popular