A steady hand from the Fed in June plus an optimistic RBA should limit downside on AUD/USD during the next few months. Further out, though, the underlying AUD trend should be gently lower, as growing bulk commodity supply gradually cools the 2016 price surge. Iron ore should be back under $80/tonne by June, with further (modest) declines likely in H2 2017.

We are still bearish on bulk commodity prices for 2017 and have not adjusted forecasts despite some upward revisions to Chinese growth in 1H17. The expectations of iron ore to average USD73/t in 2017 are still hanging around.

The quarter-to-quarter profile still marks a decline in iron ore prices over the course the year, as an eventual supply response emerges from higher cost suppliers and Chinese property sector demand moderates.

Our 4Q17 target for iron prices remains at USD66/t. For Australia, these forecasts imply that the terms of trade profile still tracks a decline over the course of the year.

The obvious read through for FX is for an eventual retracement in commodity prices to still act as a drag on AUD for the remainder of the year.

Thus, we don’t see AUD as a sustainable natural beneficiary should the market price in a greater risk premium to the USD in the event of greater trade frictions. For a small open economy leveraged to global trade, such developments should not be viewed in a positive light.

Canada: BoC’s governor Poloz speech is scheduled for late today, the statement from BoC’s March 1st meeting reiterated the point that, unlike the US, Canada was an economy that continues to be beset by material excess economic slack, and thus warrants a policy stance that remains very dovish.

This reinforce an argument made by Governor Poloz in his January policy meeting press conference that because of this cyclical divergence, it is unjustified for rising US rates and USD to drag up higher Canadian rates and CAD (in trade-weighted terms), and that recent tightening in monetary conditions from both rates and the currency was unconstructive for Canada.

Data events: BoC Gov Poloz speech on 28th March.

Canadian GDP on 31st March.

Aussie Retail Sales on 2nd April.

Aussie Trade balance on 3rd April.

RBA’s Monetary Policy on 4th April.

Canadian Trade balance on 4th April.

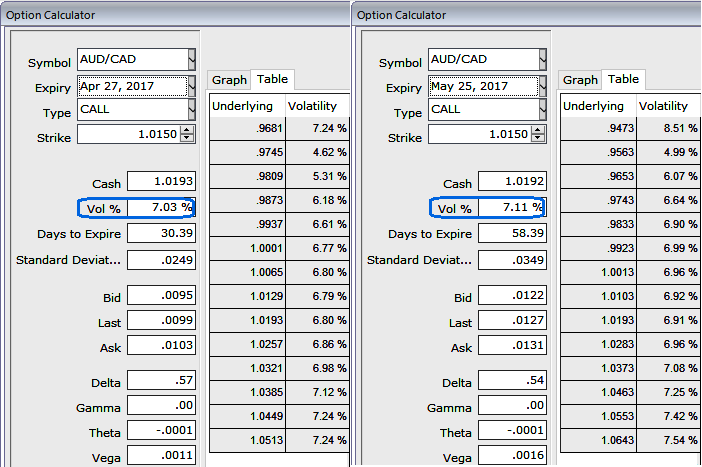

Please be noted that the implied volatilities of AUDCAD have been extremely lackluster, crawling at shy above 7% for 1m tenor and 7.11% for 2m tenor despite the flurry of data announcements as stated above.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?