GBP depreciated about 3% on a trade-weighted basis last week and is now slightly undervalued (2%), as perceptions of EU exit risk increased even though PM Cameron achieved an improved agreement with EU leaders and announced a 23 June referendum last weekend.

In U.K. PMI numbers are giving negative sentiments as the manufacturing contributions have been lackluster, the continuation in recent GBP weakness against the majors is possible this week as the February PMIs have been very poor than expected (50.8 vs forecasts 52.3). Today construction PMIs are to be released and expected to remain unchanged.

Elsewhere, the real GDP growth in Australia was a solid 0.6% q/q (not annualized) in Q4'15, following 1.1% (revised up from 0.9%) in the previous quarter. Once again, growth was driven by consumption, thanks to supportive labor market conditions and residential investment.

In contrast, business equipment investment continued to be a drag on GDP due to the decline in mining capex.

The net exports contribution was muted in 4Q15, likely owing to some payback from the large 1.6pp q/q contribution in the previous quarter. Meanwhile, the over-year-ago comparison accelerated from 2.7% in 3Q to 3.0% in 4Q, putting 2015 full year GDP growth at 2.5%.

Technically, we reckon this pair has still been showing weakness, bulls seemed to have been disappeared in the bear rout by giving up the previous rallies and evidenced 38.2% retracements so far. Leading oscillators are still downwards converging with current falling price fluctuations; you can figure this out from monthly chart in our earlier post.

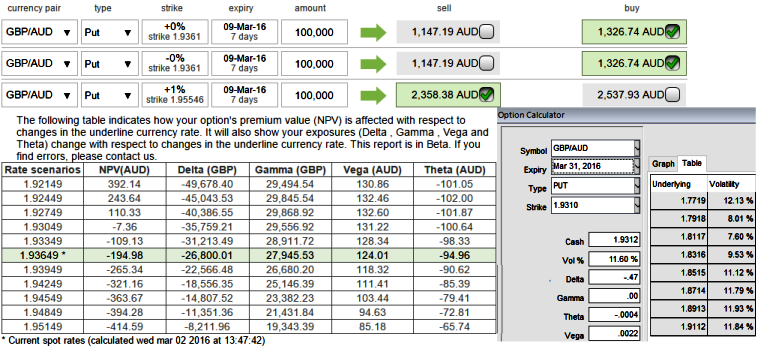

IVs are just above 11.50% and they are likely to rise in next 1 month, as a result, we recommend capitalizing on (1.5%) 2W ITM short puts matching with 2 lots of longs in 1M ATM -0.50 delta puts to construct long term backspreads at net -0.26 delta.

Let's shed some light on some guiding principles for evaluating and mitigating risk that traders may want to use to modify their inventive approach:

Use as shallow a ratio as possible.

Be sure that a large move in the underlying (targets set at 1.85 or below levels, i.e.50% fibo retracements) can be withstood without losing any money. This should be of greater concern than doing the spread for a credit.

Stress-test the spread, assuming that a move will occur any moment.

When trying to assess how a spread may perform, look at the spreads of deeper in-the-money options for an indication of relative option prices. (For a demonstrated purpose we've used 1% ITM instruments and used only 7 days on long side, in real times longer expiries on ATM contracts are desired.

Should a what-if analysis reveal that traders will lose an uncomfortable amount of money, they should either flatten out their ratio, wait for another opportunity in the cycle, or look for a spread in another pair.

FxWirePro: Aussie and British produce mixed bag of economic numbers - Improve odds on backspreads for optimal hedging on higher IVs

Wednesday, March 2, 2016 8:23 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed