The UK headlines are likely to revolve around the House of Lords, which is due to have its final reading and vote on the Article 50 Bill on Tuesday.

Given the heavy vote in favor of the amended bill (358 to 256) at its second reading, it looks likely that the Lords will pass it. As it has been amended to include a guarantee on the rights of EU citizens, it will then have to return to the House of Commons.

The government has already outlined its objections to the inclusion of additional clauses, making it likely that the Commons will reject the amendment.

Nonetheless, with the vote likely to occur sometime in the coming two weeks, this should delay, rather than derail, the Brexit process.

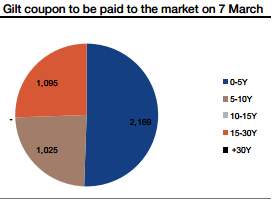

Tuesday also sees coupon payments worth £4.3bn being paid to gilt market investors. This is one of the key coupon payment dates, with the BoE due to receive £3.7bn and the DMO £0.9bn. The breakdown of the coupon that has accrued to the market is shown in above graph.

In the bigger picture, the news is not particularly constructive for gilts, with BoE asset purchases due to come to an end next week. Since the BoE started its gilt purchase programme on 8 August, it has bought £60bn of new gilts and has reinvested the proceeds from the 4% Sep-2016 (£12.1bn) and the 1.75% Jan-2017 (£11.6bn).

Over the same period, the DMO will have issued £65.1bn of conventional gilts. This, therefore, represents a net decline in the pool of available gilts of over £18.5bn. But with gross issuance averaging around £33bn per quarter over the past three years, this is likely to be more than reversed over the coming few months. We continue to favor being short gilts versus swaps, either by paying 2y2y in gilts versus receiving the swap or by positioning for 10y swap spread tightening in GBP against 10y spread widening in USD.

What is clear is that the first five years of the curve will be the main beneficiary of this cash, while ultra longs will receive no support. Coming on the back of Monday’s BoE purchases along the 3-7y part of the curve and gilts should remain relatively well supported versus swaps in the near term. A drop in predicted issuance at Wednesday’s Budget may also help gilts.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings