As widely trailed, today saw Prime Minister Theresa May announce the activation of Article 50 of the Treaty of the European Union, beginning the process of the UK’s departure from the EU. The letter, delivered to the office of EU Council President Tusk, set out some key aspirations for the UK’s terms of departure, and the future relationship with the EU.

Relative to Theresa May’s speech of 17 January – an exposé of the UK’s broad negotiating objectives – the main sources of difference were in tone, rather than content. Key aims around taking the UK out of the jurisdiction of the European Court of Justice, a departure from the EU single market – moving instead towards a “deep and special” trade agreement with the EU that includes financial services – and maintaining the common travel area with Ireland were repeated either in PM May’s statement to the House of Commons, or in the letter to Tusk.

Also confirmed was the UK’s intention to discuss the terms of departure alongside the future deal, aiming to reach agreement on the future relationship by the two-year expiry of the Article 50 process. May’s letter also speaks of implementation periods to avoid cliff-edges as the UK’s current EU membership expires, with “minimizing disruption” seen as an explicit aim.

Overall, today’s announced brought few surprises and saw a little lasting market reaction. The UK’s aspiration to discuss the exit terms in parallel with the new agreement has been communicated in the past, but may be at variance with the EU’s preference to take a sequential approach that deals with exit-related issues before discussing a future relationship.

The sterling was off 0.23% at $1.2418 at 09:00 ET after an intraday low of $1.2378. Sterling had briefly edged higher hitting an intraday maximum of $1.2475 before falling back again.

The British unit was up 0.30% at €1.1548 against the single currency. The euro was off 0.52% at $1.0757.

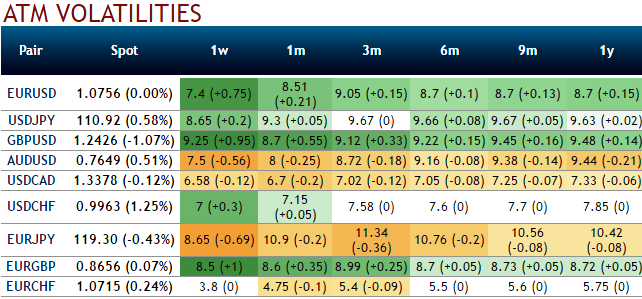

Buy GBPUSD 3m1m risk reversal strikes 1.26/1.21: we buy 3m risk reversals again that favors bearish sentiments since the GBPUSD’s implied volatility is perceived to be rising among the major currency counterparts (3m ATM contracts spiking above 9.12% in recent times.

While the 3m-1y delta risk reversal indicates hedgers have been ready to pay high premiums on OTM puts in longer time horizon.

So relying on the OTC indications, one can execute the option strategy on hedging grounds as stated below:

It is advisable to construct option strips strategy so as to mitigate the risks associated with this pair. To execute this strategy, go long in 2 lots of 3m ATM -0.49 delta puts and simultaneously, short 1 lot of ATM +0.52 delta calls of 1m tenor.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data