The Mexican central bank’s (Banxico) meeting minutes give the impression that massive rate cuts in support of the economy are rather unlikely. Even though the central bank cut its key rate by 50bp to 6.5% on 20th March, one week ahead of the regular meeting, one of the five members voted in favour of a smaller 25bp cut. And the minutes sound clearly cautious. On the one hand the central bank sees a high upside and also downside risk for inflation. After all what is going to be more pronounced? The supply side or the demand shock? And to what extent will the weak peso push inflation upwards? Can the significant fall of the oil price and other commodity prices (over) compensate for this development? And in the end of course the realisation that it is really up to the Ministry of Health and that of Finance to control the pandemic and cushion economic effects. The high Mexican key rate was so far unable to prevent the peso from depreciating significantly. Uncertainty is too high for that. From a longer term perspective, once the situation has calmed down again and investors begin investing in EM asset once again, it might help the peso that interest rates in Mexico are comparatively high (we only expect moderate rate cuts this year to 5.75%). Until then investors are more likely to be driven by concerns that both monetary and fiscal policy have reacted only moderately to the deterioration of the economic situation. The peso should therefore continue to struggle.

OTC Updates and Options Strategies:

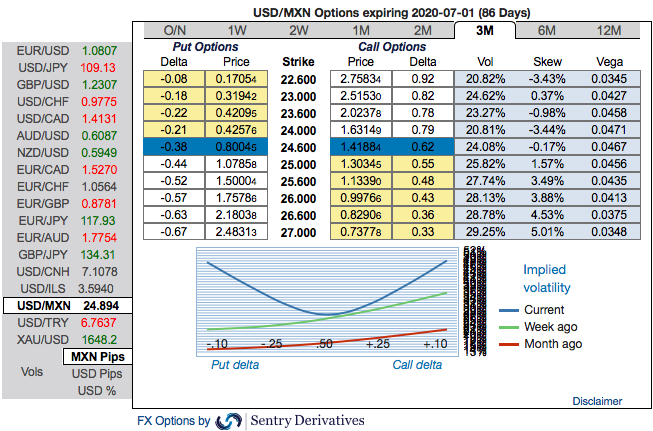

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks, while IV remains on lower side and it is perceived to be conducive for options writers.

It is analysed that earning theta without taking left tail risk via high beta ratio call spreads. Such structures are covered to a fair extent against spikes of high beta volatility given the long risk-reversal sensitivity embedded in the structure.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 22.80/25.77 indicative. Courtesy: Sentry & Commerzbank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation