The bulls have reacted as anticipated by FxWirePro two months ago; before we begin with this write-up please go through below weblink for our previous article on this pair:

On the monthly chart, amid the prevailing uptrend from last two months, bulls have managed bounce above EMAs.

Finally sustained the break above the very important 1.0765 area, and now targets 1.0875 (Feb 2016 minor peaks) during the week ahead.

The bullish engulfing pattern at 1.0644 levels (see recent month’s candle).

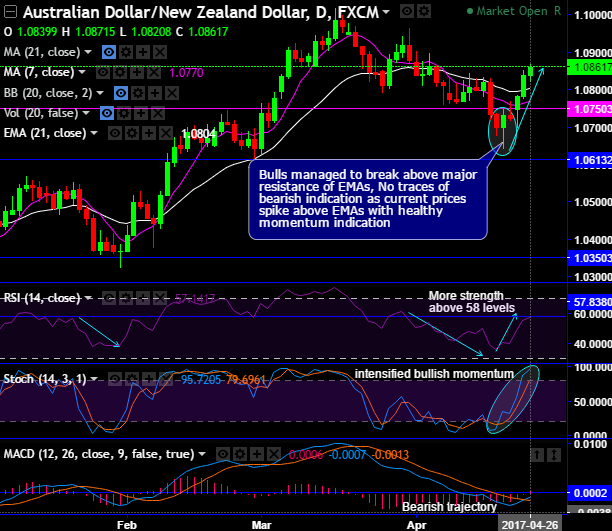

On daily plotting, the bulls have managed to break above the major resistance of EMAs, no traces of bearish indication as current prices spike above EMAs with healthy momentum indication.

The current prices on both weekly as well as monthly terms are well above WMAs and EMAs respectively.

Bulls unlikely to break resistances of 1.0950, instead, expect the range bounded trend to persist as momentum indicators show losing strength.

Bulls seem to be likely to drag rallies but the major trend should not be deemed as uptrend.

While MACD on daily and monthly term remain below zero level which is bearish trajectory, the lagging oscillator indicates mild upswings to prolong but evidence indecisiveness.

Trade tips:

For intraday trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 1.0890 and lower strikes at 1.0804 which mean upward travel maximum upto 30 pips and 60 on southward targets within the binary expiry duration.

Although short-term bulls can speculate this pair whereas long-term investors at current juncture contemplating major trend, we advocate shorting futures contract of mid-month or near month expiries to arrest downside risks upto 1.0670 or even 1.0493 levels cannot be ruled out upon breach of the 1st target.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.