On the back of formidable economic data and the improved outlook for both domestic and foreign demand, we have revised our calls on GDP dynamics, the labor market, CNB policy, and the financial markets. We now expect two CNB hikes in 2017 (on 3 August and subsequently in 4Q’17), and three more hikes in 2018. The koruna is set to appreciate to EURCZK 25.70 in 3Q’17 and to EURCZK 25.00 by end-2018.

CZK is around 5% undervalued based on our BEER and FEER models. While the already long CZK positioning may prove a hurdle for short-term appreciation (the latest JPM Client Survey shows investor longs remain at record highs), we think the currency will find support from a central bank that is gradually turning hawkish.

We continue to hold shorts in EURCZK forwards exchange contracts of 27-Nov-17 expiries. The call is revised our end-2017 EURCZK forecast up to 25, given the lower than expected volatility of the currency post floor removal.

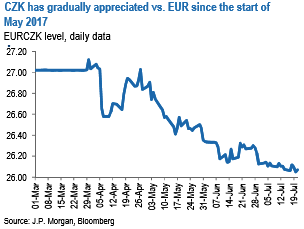

Further robust domestic macroeconomic performance and a forthcoming CNB rate hiking cycle reinforce our bullish koruna stance. The koruna has steadily appreciated against the euro since the start of May (following the exit of the EURCZK floor on 6th April), briefly trading below 26.00 this week (refer above diagram). We expect further appreciation of the currency and hold existing allocations and trades.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks