AUDUSD bearish potential to slide further towards 0.7185 levels during the next day or two, responding to a stronger US dollar.

Medium-term perspectives: Australia’s strong trade surpluses reinforce the positive story from the commodity price up trend since July, lifting some of the US-China trade war risk premium. Upbeat RBA outlook also helps; scope for a test of 0.7350-0.7400 near term. But relentless grind in yield spreads favouring USD should cap; back below 0.72 by year-end.

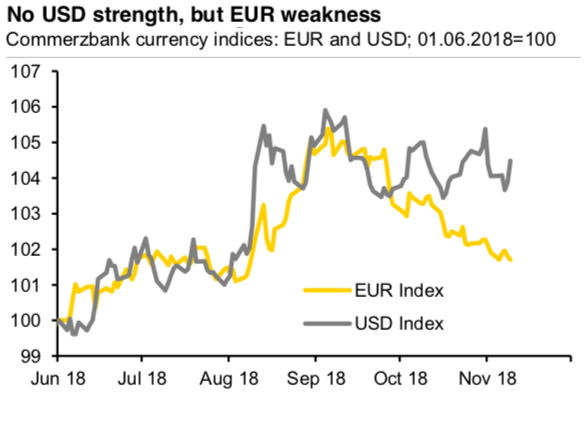

We are not seeing a “king dollar” or whatever you may want to call general USD strength. Since mid-August our USD index has been moving sideways (1stchart). Of course, on Friday the US currency was boosted (amongst other things by surprisingly high PPI inflation, refer 2ndchart, but on the whole no dollar up- trend is discernible.

AUDUSD has lost a little more ground over the last month to be down around 1.5% since JPM’s last Key Currency Views, which is in line with the trend monthly rate of decline since January.

AUD may be running out of catalysts for material downside. Net shorts in AUD remain at extreme levels, particularly for leveraged investors (3rdchart).

AUDUSD is beginning to holdin a little better than might have been expected given the Jan-16 shift in sentiment towards the currency, particularly given that AUD shorts are the hedge of choice for EM.

The stabilization near-term has also been forecasted, but foresee the underlying pair at 0.68 levels by mid-2019.

OTC outlook and Hedging Perspectives (AUDUSD):

Before proceeding further into the strategic framework, let’s just quickly glance through the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.68 levels which is in line with above projections (refer above nutshell). While positive shift in risk reversals are in sync with momentary upswings in the underlying spot fx, bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks, refer 2nd(RR) nutshell.

Accordingly, we have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1m tenors, theta shorts in short-term to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit.We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

The execution of hedging strategy:Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 6m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium. Courtesy: JPM, Sentrix and Saxo

Currency Strength Index:FxWirePro's hourly AUD spot index is inching towards -55 levels (which is bearish), hourly USD spot index was at 125 (bullish), while articulating (at 10:59 GMT). For more details on the index, please refer below weblink:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge