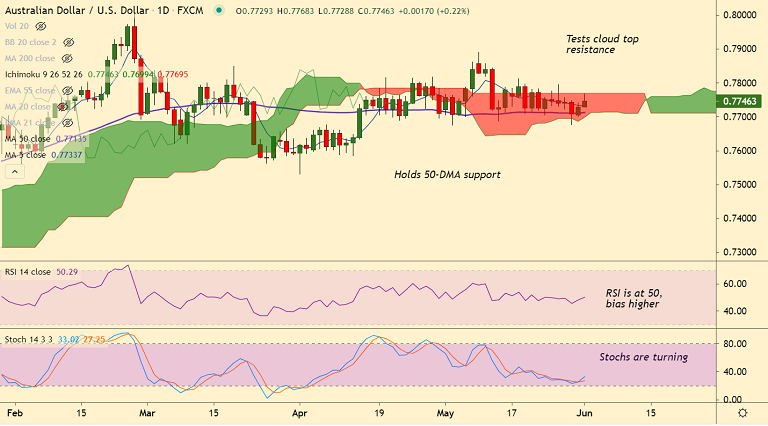

AUD/USD chart - Trading View

AUD/USD was trading 0.25% higher on the day at 0.7749 at around 04:40 GMT, slightly lower from session highs at 0.7768.

Upside in the pair has found some rejection at cloud top resistance at 0.7769, breakout above will fuel further gains.

Data released earlier today showed China Caixin/Markit Manufacturing Purchasing Managers' Index (PMI) rose to 52.0 in May, beating expectations for an unchanged 51.9 reading.

This was the highest level since December, reinstalling risk-on sentiment in the markets and thereby supporting the antipodeans.

US dollar index (DXY) remains on the back foot for the second consecutive day on early Tuesday after closing with a Gravestone Doji on Friday's trade.

Technical bias for the pair is neutral with a bullish tilt. Decisive break above cloud will see upside continuation.

Focus now remains on the key US PMI data ahead of Friday’s US Nonfarm Payrolls (NFP). US ISM Manufacturing PMI is likely to stay at 60.7 level.

Any disappointment from the US PMI data will prove counterproductive for the US dollar and could add to the AUD/USD upside.