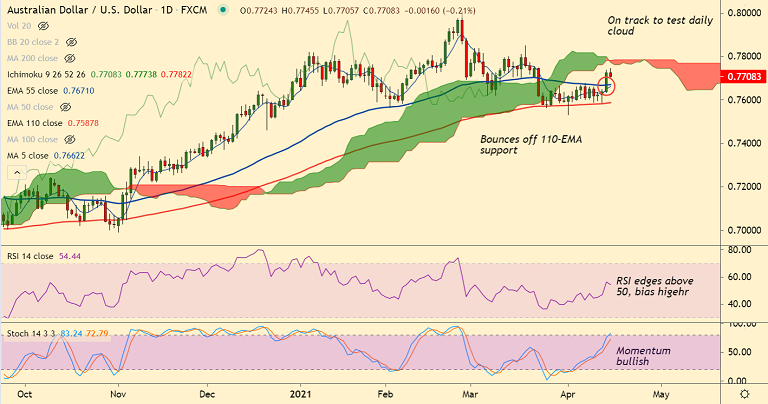

AUD/USD chart - Trading View

AUD/USD has pared some of the upbeat Australia employment-led gains and was trading at 0.7710 at around 04:40 GMT.

Fears of a fresh US-China tussle seem to weigh on the risk sentiment, keeping a lid on gains.

The pair earlier hit 3-week highs at 0.7745 after Australia's March employment figures showed a big beat on forecasts.

Data released by the Australian Bureau of Statistics showed Australia Unemployment Rate stood at 5.6%, lesser than forecasts at 5.7%.

Fears of a fresh US-China tussle seem to weigh on market risk. China’s top diplomat has indirectly warned the US over its meddling in internal affairs.

Also, the recent halt in the US 10-year Treasury yields which support US dollar index (DXY) exert downside pressure on the AUD/USD prices.

Technical indicators for the pair are turning bullish. MACD shows bullish crossover on signal line. Bullish 5-DMA crossover on 20-DMA also adds to the bullish bias.

Price action is consolidating previous session's whopping gains. Price action closed above 55-EMA and is on track to test cloud at 0.7773. Breakout above cloud will propel the pair higher.