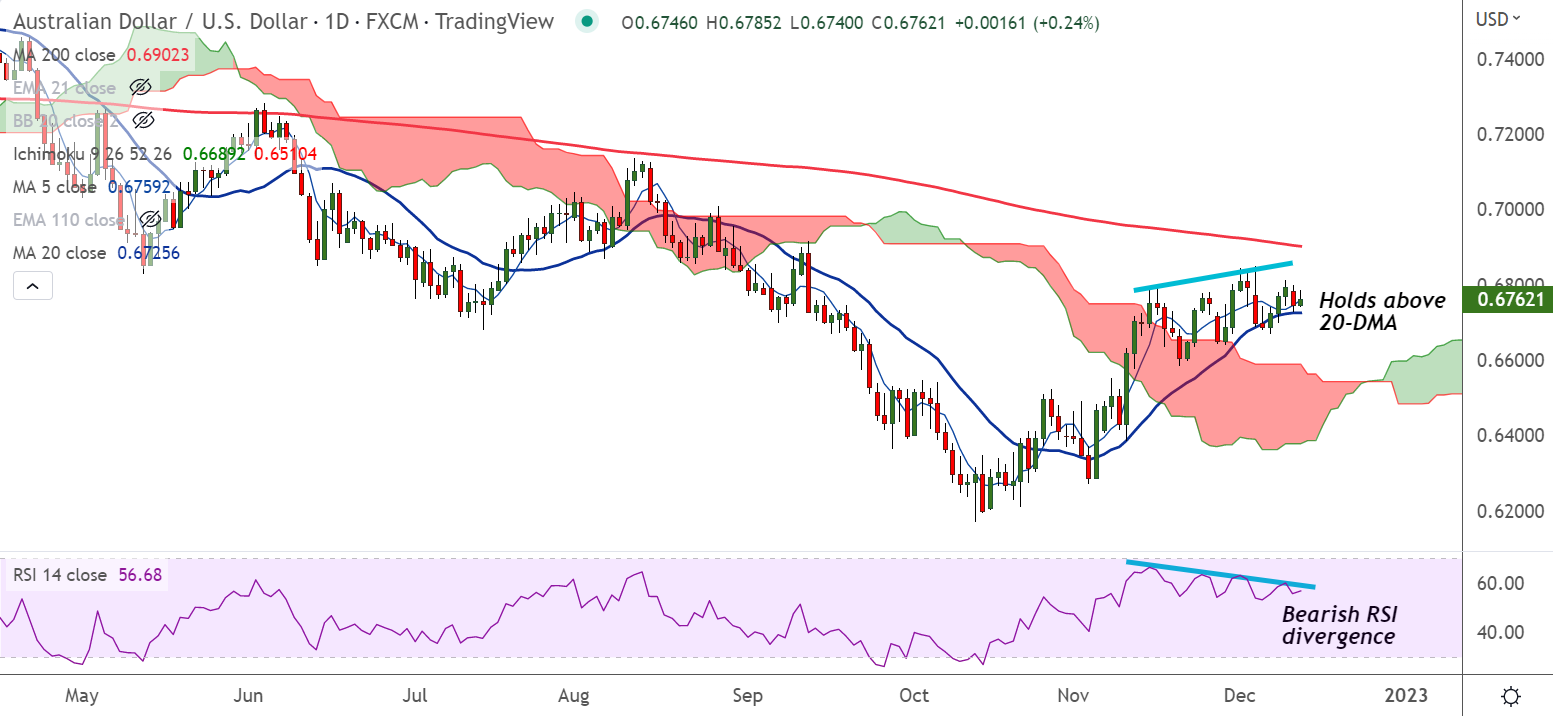

Chart - Courtesy Trading View

AUD/USD was trading 0.15% higher on the day at 0.6756 at around 10:20 GMT, slips lower from session highs at 0.6785.

Weaker US dollar and easing of COVID-19 curbs in China remained supportive of a generally positive risk tone, aiding upside in the pair.

That said, downbeat Australian data, fears of the Sino-America tussles and hawkish hopes from the Federal Reserve limit upside in the pair.

Data released earlier today showed National Australia Bank’s (NAB) Business Confidence gauge slumped to -4.0 for November versus 5.0 expected and 0.0 prior.

Further, the NAB Business Conditions also eased to 20.0 while matching market forecasts, compared to 22.0 prior.

Further, caution likely seen among traders ahead of the release of US Consumer Price Index (CPI) data for November.

US CPI for November is likely to ease to 7.3% YoY, versus the 7.7% prior, while the monthly CPI may retreat to 0.3% compared to 0.4% in the prior month.

Major Support Levels:

S1: 0.6726 (20-DMA)

S2: 0.6704 (110-EMA)

Major Resistance Levels:

R1: 0.6838 (Upper BB)

R2: 0.6902 (200-DMA)

Summary: AUD/USD resumes upside after minor intraday pullback. Scope for downside remains amid bearish RSI divergence.