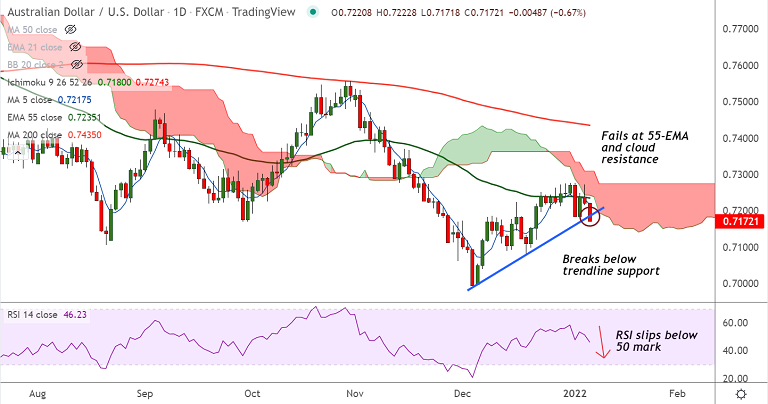

Chart - Courtesy Trading View

AUD/USD was trading 0.87% lower on the day at 0.7158 at around 07:45 GMT, bias turns bearish.

The antipodeans were dented amid rising virus concerns and geopolitical risks. Caution prevails ahead of Friday’s US Nonfarm Payrolls (NFP).

Upbeat prints of China’s private activity gauge failed to impress. China’s Caixin Services PMI rose past 52.1 figures flashed in November to 53.3 for December.

FOMC minutes overnight showed Fed policymakers discussed faster rate-hike and plans for balance-sheet normalization during the latest FOMC meeting.

As a result, the Fed interest rate futures pointed at the 80% chance of a hike in March 2022 after the Fed minutes.

The US dollar got an unexpected boost from the US Federal Reserve’s Meeting Minutes. DXY erased early losses to edge higher from session lows at 95.88 and closed at 96.18.

The major failed to extend break above 55-EMA, found rejection at daily cloud. RSI has turned and has slipped below 50 mark.

Technical bias for the pair has turned bearish. The pair has broken below major trendline support at 0.7185 and has slipped below 200-week MA.

Bears likely to target lower Bollinger band at 0.7096. Further weakness will see dip till 0.6993 (Dec 2021 low).