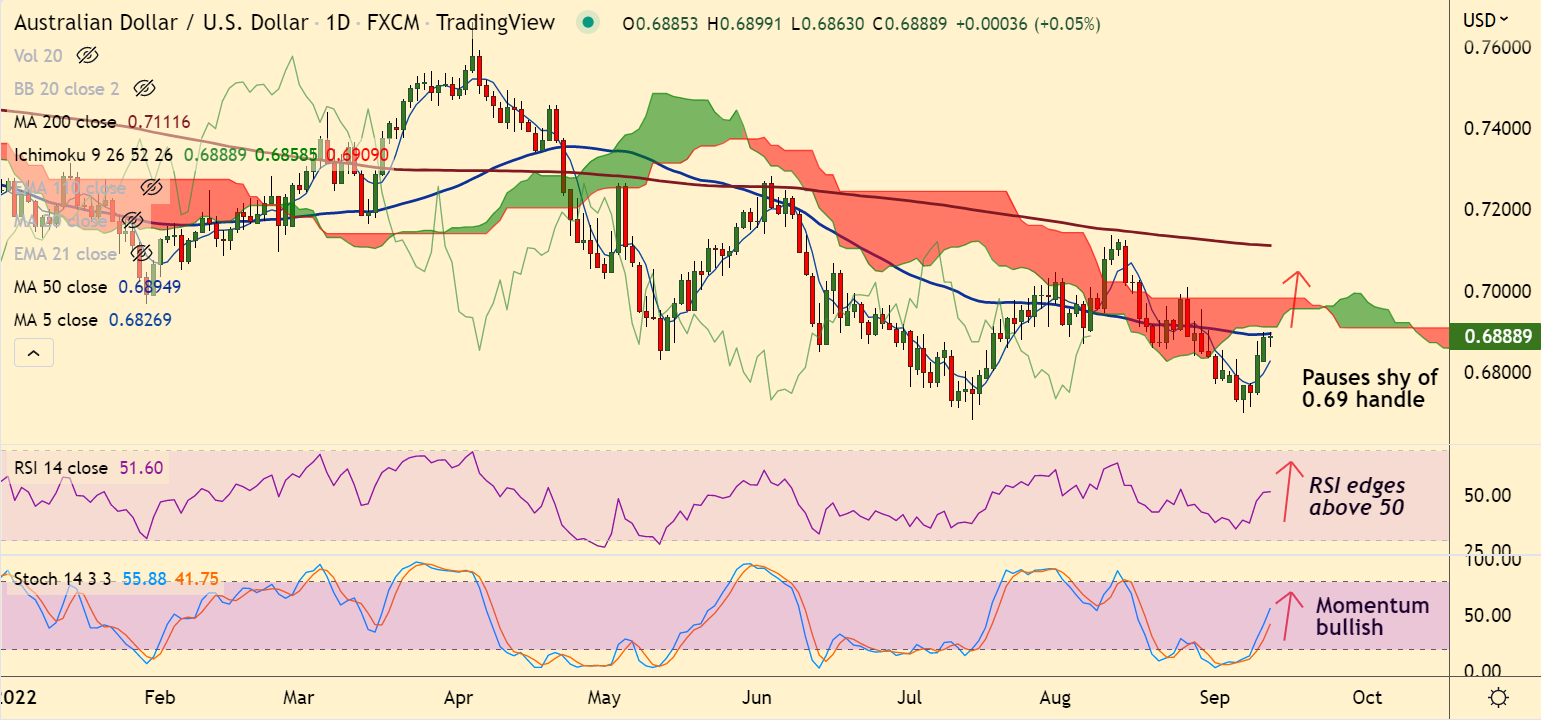

Chart - Courtesy Trading View

AUD/USD was trading largely unchanged at 0.6883 at around 06:40 GMT.

The major has snapped two-day upside at 50-DMA which is offering stiff resistance at 0.6894.

Focus is on employment data, which will scheduled for release on Thursday. Upbeat data will strengthen the aussie dollar further.

The jobless rate is expected to remain steady at 3.4%, while the Employment Change is expected to rise by 35k.

Price action has edged above 200H MA, GMMA indicator shows major and minor trend have turned bullish on the intraday charts.

Momentum has turned bullish. Stochs and RSI are biased higher, Stochs show bullish rollover from oversold levels.

Support levels:

S1: 0.6860 (21-EMA)

S2: 0.6825 (5-DMA)

Resistance levels:

R1: 0.6913 (55-EMA)

R2: 0.6989 (110-EMA)

Summary: AUD/USD pauses at 50-DMA resistance. Major trend remains bullish and decisive break above 50-DMA will fuel further upside in the pair.