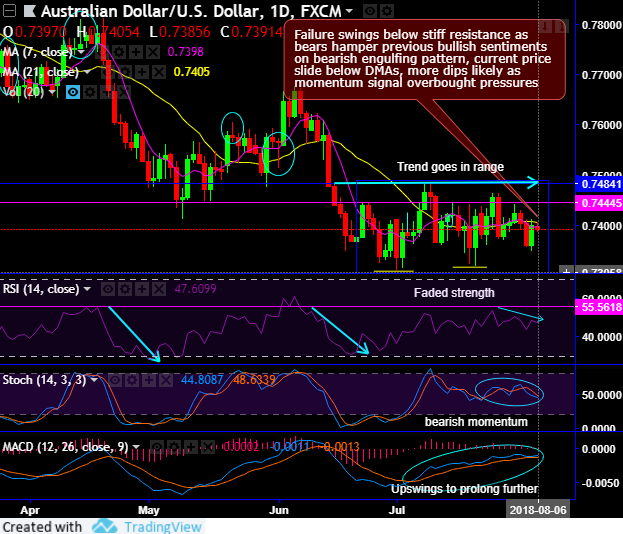

AUDUSD forms bearish engulfing patterns at 0.7366 and 0.7376 levels and the stiff resistance is observed at 0.7444 – 0.7484 areas.

Ever since the formation of aforementioned bearish patterns, the failure swings are observed below that stiff resistance as bears hamper the previous bullish sentiments on bearish engulfing patterns, consequently, the current price slides below DMAs. For now, more dips seem to be on cards as the momentum signal bearish pressures.

As a result of this sort of price behaviour has been prolonged from last 4-6 weeks, the trend has been drifting range as you can see the rectangular area on daily plotting.

The intermediate trend has been extending double top formation with the breach below the neckline, in the recent past, bearish engulfing candle followed by shooting star patterns plummet prices below 7EMA again. In this journey, the pair shrugs off hammer pattern candle as bears extend price slumps.

Both RSI and stochastic curves have constantly been showing downward convergence to signal bearish momentum.

The Aussie has been one of the worst performers in the broad-based US dollar rally since the June FOMC and ECB meetings. For now, RBA is scheduled for the monetary policy this week and the Aussie outlook to be on hold throughout 2018 that is anchoring short-maturity interest rates.

Trade tips: On trading perspective, at spot reference: 0.7394 levels, ahead of this week’s RBA’s monetary policy, it is advisable to buy at-the-money vanilla put option of 1w expiries, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping lower on the expiration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.72 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -2 levels (which is bearish), while hourly USD spot index was at 41 (bullish) while articulating (at 07:20 GMT). For more details on the index, please refer below weblink: