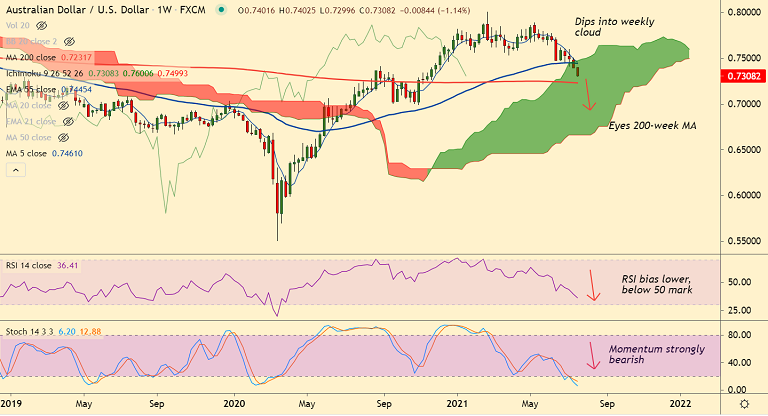

AUD/USD chart - Trading View

AUD/USD was trading 0.26% lower on the day at 0.7309 at around 05:00 GMT, outlook bearish.

Disappointing Australia Retail Sales data and escalating covid woes keep the antipodean depressed.

Australia's Retail Sales disappoint dropped by 1.8% in June, much more than a drop of 0.5% expected.

Analysts now forecast Australia's growth at 0.1% Q/Q, compared with 0.9% predicted in April, in light of the extended lockdowns and slow vaccination.

Further, escalating US-Sino tensions and virus woes keep risk sentiment sour and investors away from risky assets.

Technical bias for the pair is also bearish. Price action is on track to test 0.7231 (converged 200-week MA and 76.4% Fib).