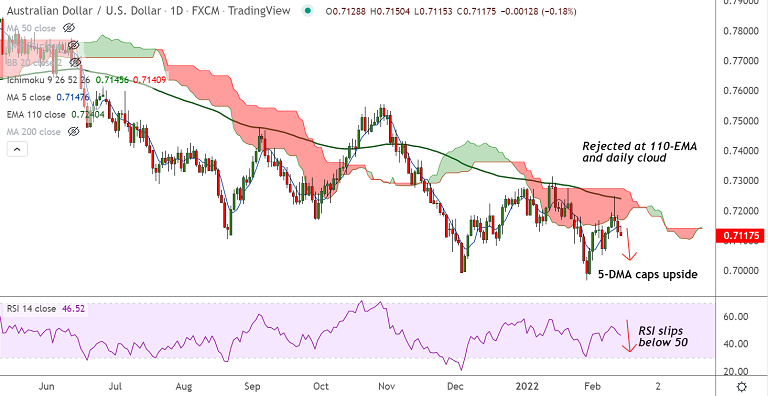

Chart - Courtesy Trading View

AUD/USD was trading 0.15% lower on the day at 0.7120 at around 04:30 GMT.

The pair is extending Friday's weakness, slips lower for the 3rd consecutive session.

Escalating fears over Russia’s invasion of Ukraine and bearish signals from the Commodity Futures Trading Commission (CFTC) weigh on the antipodeans.

Reserve Bank of Australia’s (RBA) recently bearish rhetoric keeps bearish pressure. Focus now on minutes from the RBA and Fed due Tuesday and Wednesday respectively.

Technical bias for the pair is bearish. Upside was rejected at 110-EMA and is now extending weakness below daily cloud.

GMMA indicator shows major and minor trend are bearish. Stochs and RSI are biased lower, with RSI below the 50 mark.

Major Support Levels:

S1: 0.7097(5-week MA)

S2: 0.7015 (Feb 4th low)

S3: 0.6967 (Yearly low)

Major Resistance Levels:

R1: 0.7141 (21-EMA)

R2: 0.7155 (200-week MA)

R3: 0.7178 (55-EMA)

Summary: AUD/USD trades with a bearish technical bias. Scope for further downside. Test of yearly lows at 0.6967 likely.