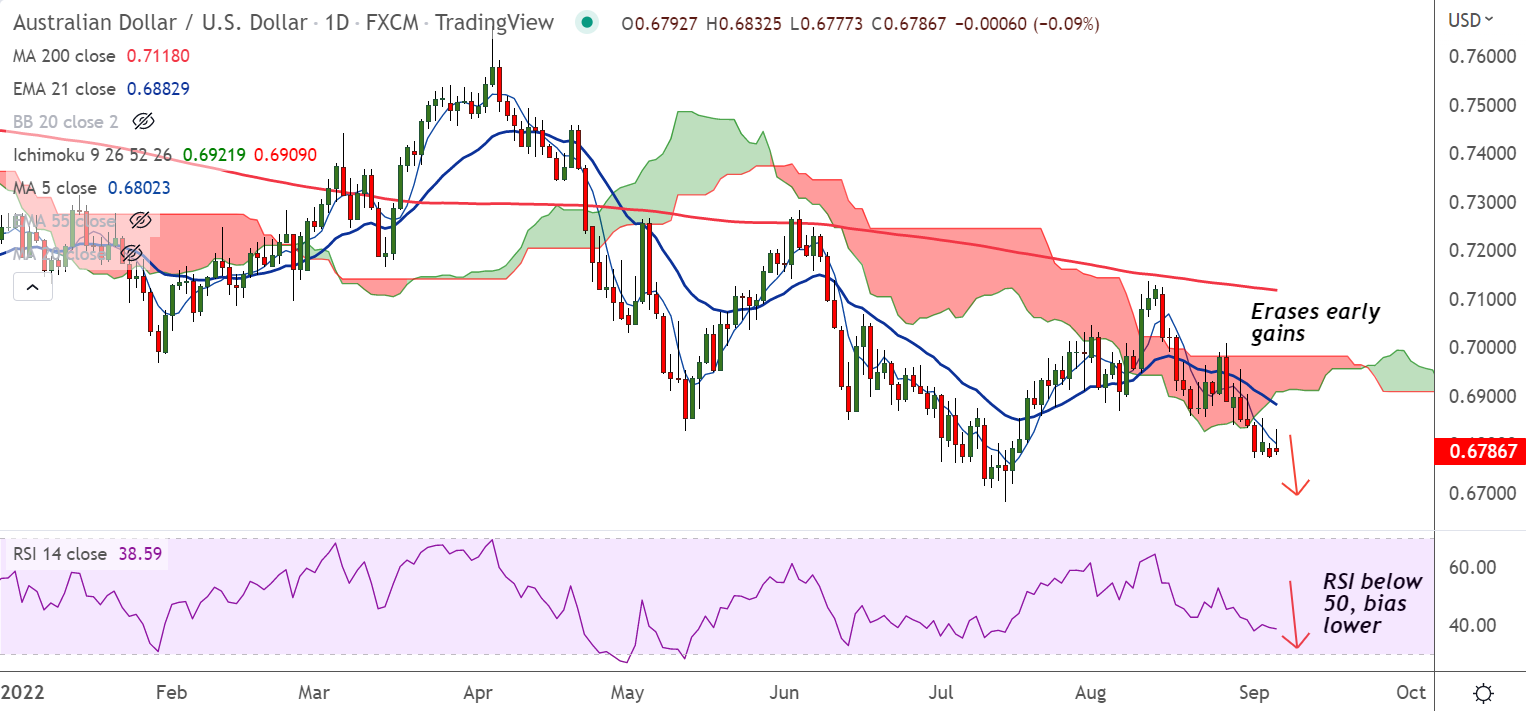

Chart - Courtesy Trading View

AUD/USD was trading 0.11% lower on the day at 0.6786 at around 07:30 GMT.

The pair has slipped lower from session highs at 0.6832, outlook remains bearish.

Reserve Bank of Australia (RBA) increased the benchmark rates by 50 bps to 2.35% early on Tuesday.

The central bank decision was in line with market expectations and its fourth consecutive rate hike of 50 bps.

In the statement that followed, the central bank said that the board is committed to doing what is necessary to ensure inflation returns to target.

Aussie failed to benefit from the RBA decision and the firmer statement, as fears of cooling household spending in Australia kept downside pressure.

Technical indicators are supportive of further downside in the pair. Price action has failed to hold break above 5-DMA.

Major Support Levels:

S1: 0.6717 (Lower BB)

S2: 0.67

Major Resistance Levels:

R1: 0.6802 (5-DMA)

R2: 0.6882 (21-EMA)

Summary: AUD/USD poised for more downside. Slip below 0.67 handle likely.