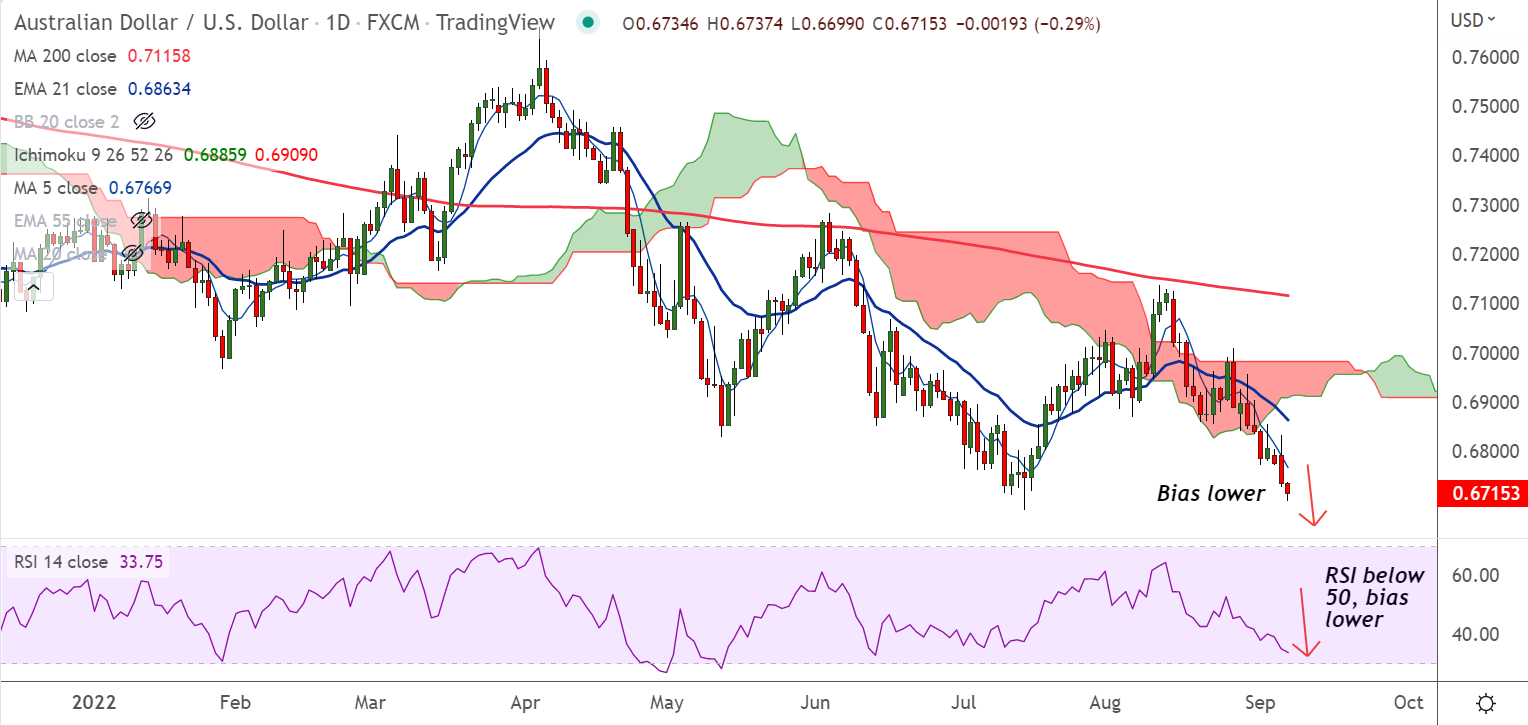

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.26% lower on the day at 0.6717 at around 06:25 GMT

Previous Week's High/ Low: 0.6956/ 0.6771

Previous Session's High/ Low: 0.6832/ 0.6727

Fundamental Overview:

China’s Trade Balance has slipped sharply to $79.39B against the expectations of $92.7B.

Details of the report showed imports slumped to 0.3% against the expectations at 1.1% and 2.3% prior. Exports fell to 7.1% vs. estimates of 12.8%.

Australia's Gross Domestic Product (GDP) printed at 0.9%, lower than the expectations of 1% but above the prior release of 0.8% on a quarterly basis.

However, the annual data has improved to 3.6% against the estimates and the prior print of 3.5% and 3.3% respectively.

Upbeat US dollar index (DXY) amid hawkish Fed bets after firmer US data add to downside pressure on the pair.

Technical Analysis:

- AUD/USD extends weakness below daily cloud

- Stochs and RSI are sharply lower, momentum with the bears

- Volatility is high and rising, Chikou span is biased lower

- GMMA indicator shows major and minor trend are strongly bearish

Major Support and Resistance Levels:

Support - 0.6686 (Lower BB), Resistance - 0.6768 (5-DMA)

Summary: AUD/USD poised for further downside. Technical indicators support weakness in the pair. Scope for test of fresh yearly lows below 0.6681.