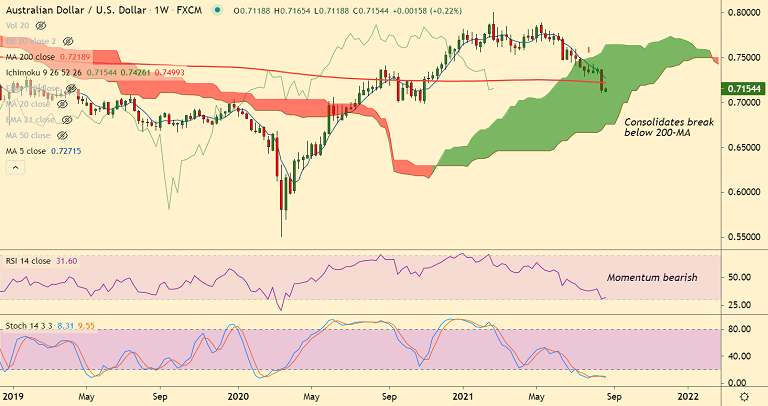

AUD/USD chart - Trading View

Technical Analysis:

GMMA Indicator - Bearish

Ichimoku Analysis - Bearish

Oscillators - At oversold

Bollinger Bands - High volatility

Fundamental Overview:

Risk appetite improves with global equities and higher US benchmark Treasury yields supporting the Aussie.

Australia’s Commonwealth Bank Manufacturing Purchasing Managers Index ( PMI) for August slipped to 51.7 from 56.9 in the previous month and missed estimates at 56.7.

The Services Purchasing Managers Index ( PMI) for August was down to 43.3 from 44.2 in the previous month and missed estimates at 44.

Major Support Levels: 0.71, 0.7051 (38.2% Fib), 0.70

Major Resistance Levels: 0.7184 (5-DMA), 0.72, 0.7218 (200-week MA)

Summary: AUD/USD is consolidating previous week's break below 200-week MA. Price action is showing some retracement from multi-week lows. The pair has bounced off with a spinning top formation. However, recovery lacks traction, upside is likely to be limited.