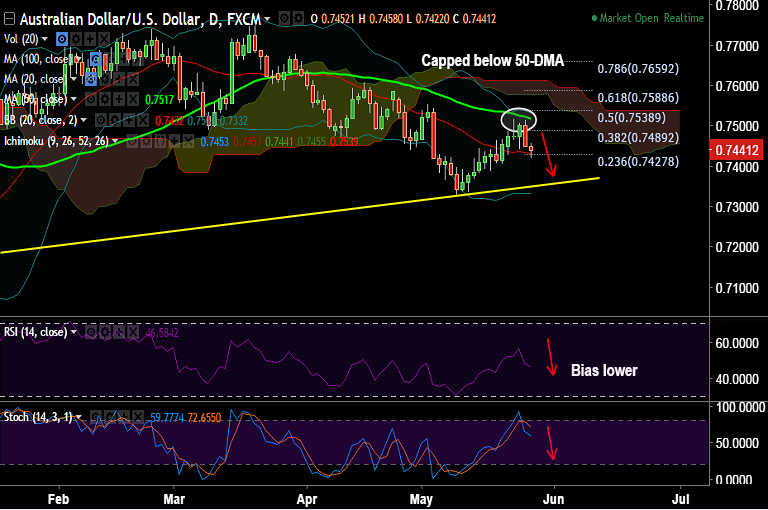

- AUD/USD fails to break above stiff resistance by 50-DMA at 0.7517, further downside likely.

- Momentum has turned bearish, RSI and Stochs have turned south.

- The pair has broken below 20-DMA at 0.7432, and has pared some losses to currently trade at 0.7441 levels.

- Close below 20-DMA could see drag upto 0.7355 (trendline support). Violation there will see test of 0.7328 (May 9th low).

- US dollar index is clinching higher for second consecutive session, markets leave behind the FOMC minutes.

- Focus now on second revision of Q1 GDP is due along with durable goods orders and the final print of the Reuters/Michigan index for the month of May.

Support levels - 0.7432 (20-DMA), 0.7428 (23.6% Fibo 0.7749 to 0.7329 fall), 0.7355 (trendline), 0.7328 (May 9 low)

Resistance levels - 0.7468 (5-DMA), 0.75 (psychological level), 0.7537 (200-DMA), 0.7588 (61.8% Fib)

Recommendation: Good to go short on decisive break below 20-DMA, SL: 0.7470, TP: 0.7355/ 0.7330

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -67.7148 (Neutral), while Hourly USD Spot Index was at -35.6994(Neutral) at 0720 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.