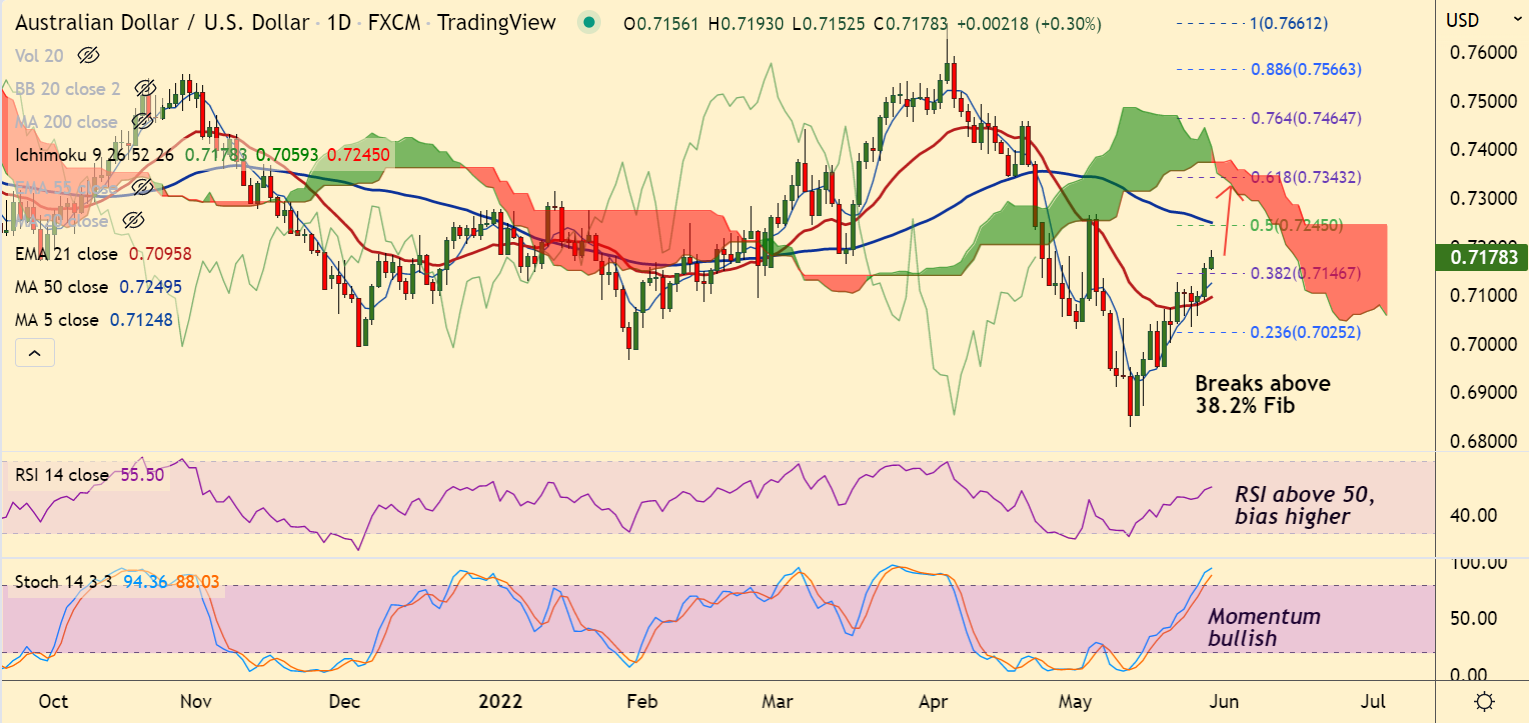

Chart - Courtesy Trading View

AUD/USD was trading 0.32% higher on the day at 0.7179 at around 07:30 GMT, outlook is bullish.

The pair has broken above 38.2% Fib retracement and is on track to test 50% Fib at 0.7245.

Weaker US dollar and risk-on impulse across the markets is supporting gains in the major.

US dollar index (DXY) has tumbled in the early trade to its monthly lows at 101.38. Focus remains on the US Non-Farm-Payrolls data.

Analysts expect the preliminary estimate for the US NFP to print at 310k against the prior print of 428k.

On the aussie front, investors are awaiting the release of the GDP numbers on Wednesday.

The annual GDP is expected to plunge to 1.6% against the prior print of 4.2%. While the quarterly figure may slip to 0.6% vs. 3.4% prior print.

Any disappointment in data could weigh on the antipodean which could drag the pair lower going forward.

Major Support Levels:

S1: 0.7146 (38.2% Fib)

S2: 0.7124 (5-DMA)

Major Resistance Levels:

R1: 0.7222 (110-EMA)

R2: 0.7245 (50% Fib)

Summary: AUD/USD trades with a bullish technical bias. The pair is on track for further gains. Next major bull target lies at 50% Fib at 0.7245.