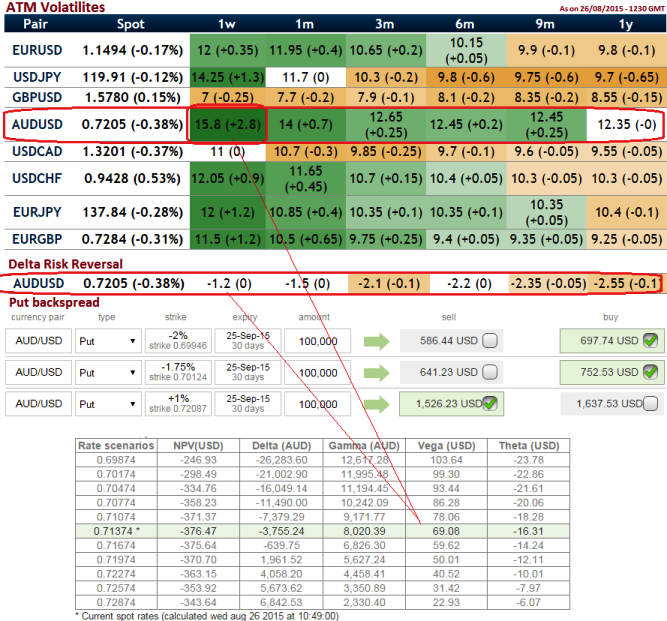

From the nutshells, it is understood that ATM vols and 25-delta risk reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced (downside protection is relatively more expensive). For the 3 months to 1 year time frame, delta risk reversal is getting closer to -2 to -2.55.

Volatility is better - AUDUSD is the highest volatile pair in next 1 month (almost close to 16%), the higher it is the higher the chances of big price movements

Vega in a back spread is generally dominated by the long options the more time there is to expiration and the closer the underlying price is to the strike price of the long options. The more time there is to expiration, generally the more positive vega the back spread. The reason for this is that far from expiration, the difference between the vega of one strike and the next is relatively small. That is the reason why we used 1M expiry on long side in order to have positive vega at 69.08 which is healthy at current high volatile conditions.

But as the time to expiration falls, the vega is generally much less positive, and can be negative, depending on whether the stock price is closer to the strike with the short options or the strike with the long options.

Set up position with 2 lots of Out of the money puts on long side and simultaneously an in the money shorts with slightly shorter maturity.

Why backspreads: Using this strategy as the bearish environment piling up on this pair, we believe AUDUSD would radically drop, and want capital gains.

Currently, AUDUSD is trading at $0.7134, Buy 2 lots of 1M (strikes 0.6994 & 0.7012) puts at $1450.27, Sell one lot of 15D in the money (strike 0.7208) put at $1526.23

Advantage: The benefit of this strategy is that you have reduced your cost of the trade by 1526.23 while capping your risk and benefiting from higher leverage as the AUDUSD drops.

Risk/Reward profile: The risk is the difference between strikes minus net credit, multiplied by the number of contracts you are selling. The reward would be unlimited until the stock drops to zero.

Effect of time decay: Negative. You need time because you are looking for a significant move.

FxWirePro: AUD/USD Vega backspreads on HY vols mitigate downside risks

Wednesday, August 26, 2015 5:48 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings