AUDUSD short-term trading momentum appears to be positive that is cushioned by risk sentiment, with 0.7900 the bullish target in the days to come.

Medium-term perspective: The Aussie remains slightly pricey compared to short-term fair value projections, as yield differentials along the curve move steadily in the US dollar’s favor.

This weight on AUD should only increase over the next year or two. Shorter-term though, markets are already priced for a Fed hike this month and no change from the RBA for many months.

Moreover, commodity prices have emerged from Asia’s Lunar New Year holidays still holding most of the late 2017 gains.

Optimism over global growth remains intact though US-driven trade tensions pose downside risks to global trade volumes and AUD. We look for 0.78 end-Mar, 0.77 end-Jun, and 0.74 end-Dec. (5 Mar).

OTC outlook and hedging perspectives:

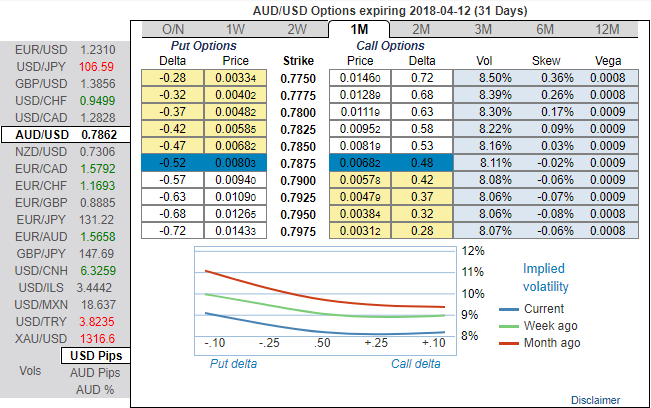

While using shrinking IVs of shorter tenors coupled with the bearish neutral risk reversal numbers that could be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market is showing momentary upswings. But has more downside potential for large movement in the weeks to come which is resulting option holders’ on competitive advantage.

Without disregarding the Fed’s rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by bearish neutral risk reversals and positively skewed IVs of 1m tenors which is an opportunity for put longs in long-term as the US central most likely to raise the Funds rates by 25 bps.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies by bidding 1w theta shorts, 1m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1w (1%) ITM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 1m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 33 levels (which is bullish), while hourly USD spot index was at a tad below 89 (bullish) while articulating (at 11:00 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis