In the minutes of the November board meeting, there was a similar sense of optimism that was presented in earlier RBA commentary. They did not appear to add a significant amount of new insight into RBA thinking.

Moreover, the Australian central bank moderately upbeat stance suggests that further rate cuts are unlikely in coming months which is line with the expectations of the markets unless incoming data diverges significantly from its forecasts.

However, in our view, the downside risks to the RBA’s growth and inflation forecasts prolong to propose that further monetary easing would be on the cards over 2017.

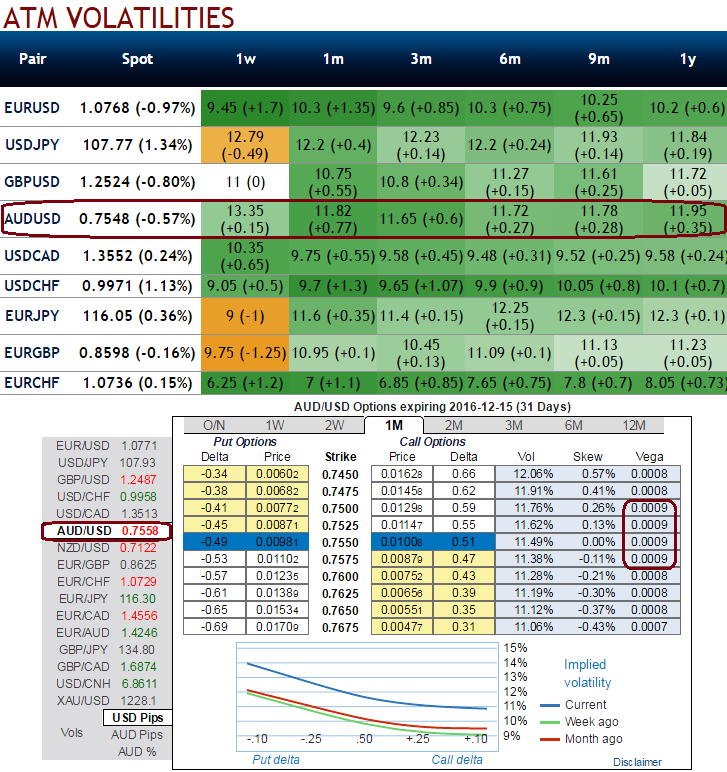

As a result, ATM implieds are rising notably, 1m tenor has successively rising IVs above 11.82% which is on the higher side, when the spot Fx of underlying pair is moving as per your expectation along with rising IVs, this is good news for option holders as such options with a higher IV costs more.

The Australian dollar has performed very well since the start of the year but is now toppish. Though the AUD and NZD need fresh catalysts to establish new trends or revive the bearish trend, they have priced in a lot of (relatively) better Chinese news, whereas the technical picture suggests that a reversal could be imminent. AUDUSD is sensing a downtrend below 0.7555 levels and will face horizontal resistance at 0.7586 levels.

Thereby, we see advantages two folded:

Firstly, for an instance, let’s suppose as shown in the diagram we are holding 1m ATM puts that has the highest vega (ATM contracts usually have the highest vega comparatively with OTM and ITM contracts).

For now, the underlying spot FX of AUDUSD keeps dipping and if you intend to speculate this pair and want to sell it again your existing puts, then the option premiums would be costlier than your buying price.

Secondly, the Vega is generally larger in options which have the longer time until expiry, and it falls as the option approaches expiry. This is because an increase in IV is more beneficial for a longer term option than for an option that will expire in short run.

Buy 1M AUDUSD vs AUDNZD vol spread, equal vega on speculative grounds.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data