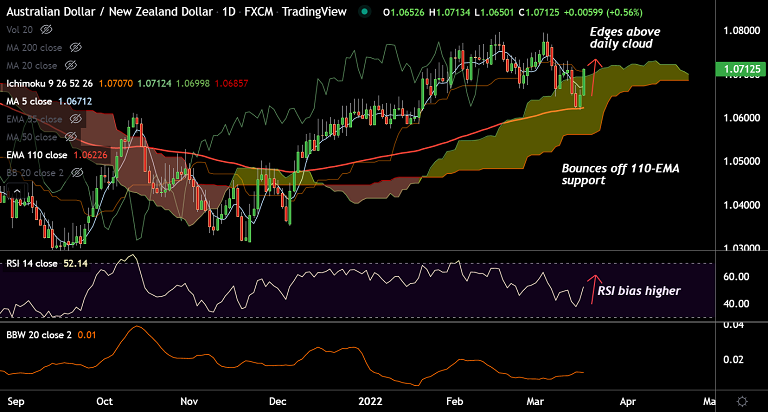

Chart - Courtesy Trading View

AUD/NZD was trading 0.54% higher on the day at 1.0709 at around 11:35 GMT.

The pair has bounced off 110-EMA support and has broken above the daily cloud.

Stochs are on verge of bullish rollover from oversold levels. RSI is above the 50 mark and biased higher.

Price action has broken above 200H MA and the GMMA indicator shows bullish shift in trend on the intraday charts.

The pair has erased most of the losses on the weekly candle and has formed a Dragonfly Doji till date.

5-week MA caps upside in the pair at 1.0716. Break above will see upside resumption. Scope for test of channel top at 1.0815.

Support levels - 1.0693 (Cloud top), 1.0671 (5-DMA), 1.0622 (110-EMA)

Resistance levels - 1.0716 (5-week MA), 1.0767 (Previous week high), 1.0815 (Channel top)

Summary: AUD/NZD poised for upside resumption. Channel top at 1.0815 in sight.