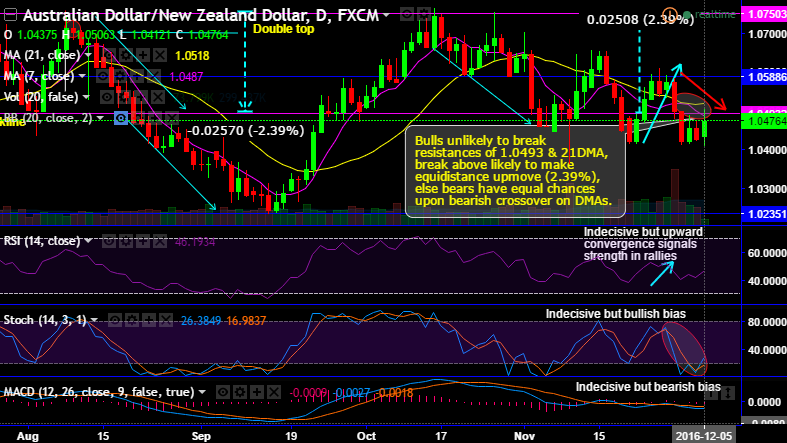

AUDNZD fell from 1.0475 to 1.0420, but the momentary bulls attempting for upside traction in short run but seems unlikely to break resistances of 1.0493 & 21DMA, only break above likely to make equidistance upmove (2.39%), else bears have equal chances upon bearish crossover on DMAs.

Even on the monthly time frame, the bulls unlikely to break resistances of 1.0485 & 21EMA, more slumps likely upto 1.0157 levels upon bearish crossover on EMAs.

The current prices attempt to spike above 7DMAs but fail to sustain, capture rallies to add fresh shorts.

RSI’s consistent downward convergence signals the strength in major bear trend (see monthly chart), while upward convergence signals the strength in prevailing rallies that could offer bullish targets of 1.0485-93 levels.

Stochastic evidences %D crossover that indicates the intensified selling momentum in the major downtrend and short-term rallies seem to be deceptive.

Bulls’ attempts of breach above resistances of 1.0485 levels but struggling to sustain above, the upswings rejecting at 21EMA as the major trend puzzling with non-directional swings.

For now, rallies began to rebuild positive momentum but struggling to break and sustain above 1.0493.

Well, in the medium term, the pair likely to head towards 1.0750 or above in 1-3 months’ timeframe. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

AU swap yields 1-3 month: The 3y has probably based at 1.60%, the RBA expected to sit tight at a 1.5% cash rate for some time.

As per FxWirePro currency strength index that measures the overall fluctuation of the domestic currency against a basket of seven other currency peers - AUD appears to be bullish, while NZD is extremely bullish. Intraday speculators can effectively utilize this tool as the index signifies the hourly performance.

Hence, we think shorting futures contracts of AUDNZD of near month expiries is the more suitable trading strategy for targets of 1.0321 levels with a strict stop loss of 1.0607 levels.

Check here for more details on currency index: http://fxwirepro.com/currencyindex