- AUD/NZD slumps to fresh 2-week lows at 1.0672 as the major extends previous week's downside.

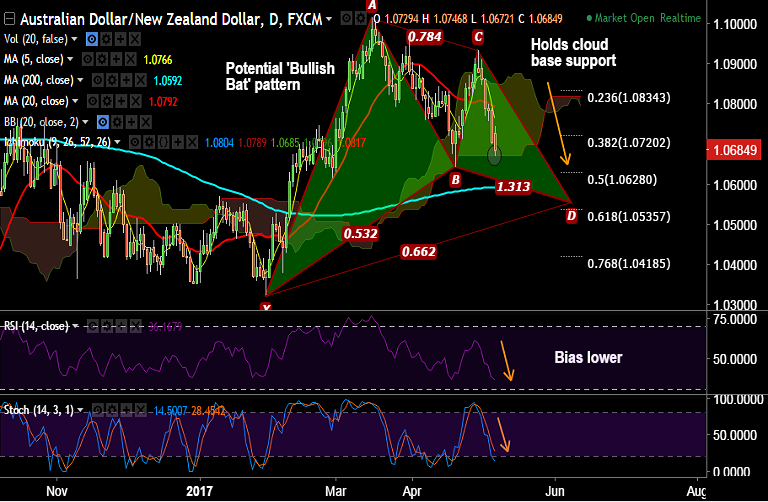

- The pair is currently holding support by daily cloud base at 1.0672 levels.

- Break below will see further downside, test of 1.0642 (April 20 low) and then 1.0616 (Feb 28 low) likely.

- Caution remains ahead of RBNZ monetary policy decision this week, which might eventually keep a lid on any swift down-move for the major.

- On the flipside, we see bearish invalidation on close above 20-DMA at 1.0792.

Support levels - 1.0672/74 (cloud base/ 100-DMA), 1.0642 (April 20 low), 1.0628 (50% Fib), 1.0592 (200-DMA)

Resistance levels - 1.07, 1.0720 (38.2% Fib), 1.0766 (5-DMA), 1.0792 (20-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Bearish Oversold

1D Bearish Neutral

1W Bearish Neutral

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-breaks-below-50-DMA-more-downswings-likely-good-to-short-rallies-677235) has hit all targets.

Recommendation: Book full profits at lows. Break below cloud base could provide opportunity for fresh shorts.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -40.4285 (Neutral), while Hourly NZD Spot Index was at 153.589 (Bullish) at 0915 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.