- AUD/NZD is extending upside for the 4th straight session, trades around 1.0763 after hitting session highs at 1.0769.

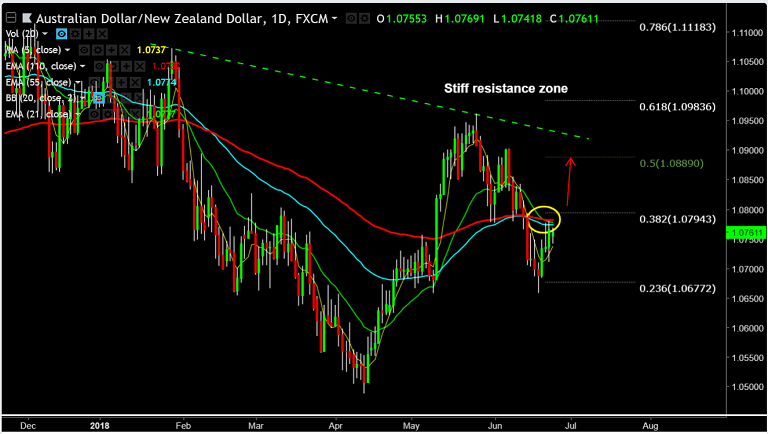

- The pair remains capped between 100-DMA and 21-EMA, breakout could provide clear directional bias.

- We expect the kiwi to weaken as we head into the Reserve Bank of New Zealand's (RBNZ) next policy meeting (due Wed).

- The RBNZ is expected to keep cash rate steady at 1.75% with little change in the policy statements.

- Majority of economists polled by Reuters also expect the central bank to remain unchanged on rates well into Q4 2019.

- Technical indicators do not provide a clear directional bias. The pair finds stiff resistance in the 1.0774 - 1.0792 zone.

- Breakout at resistance could see test of 1.093 (major trendline) ahead of 1.0983 (61.8% Fib).

- On the flipside, rejection at resistance zone could see resumption of weakness.

Support levels - 1.0738 (5-DMA), 1.07, 1.0677 (23.6% Fib)

Resistance levels - 1.0774 (55-EMA), 1.0782 (110-EMA), 1.0792 (20-DMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -6.46053 (Neutral), while Hourly NZD Spot Index was at -45.3397 (Neutral) at 0945 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.