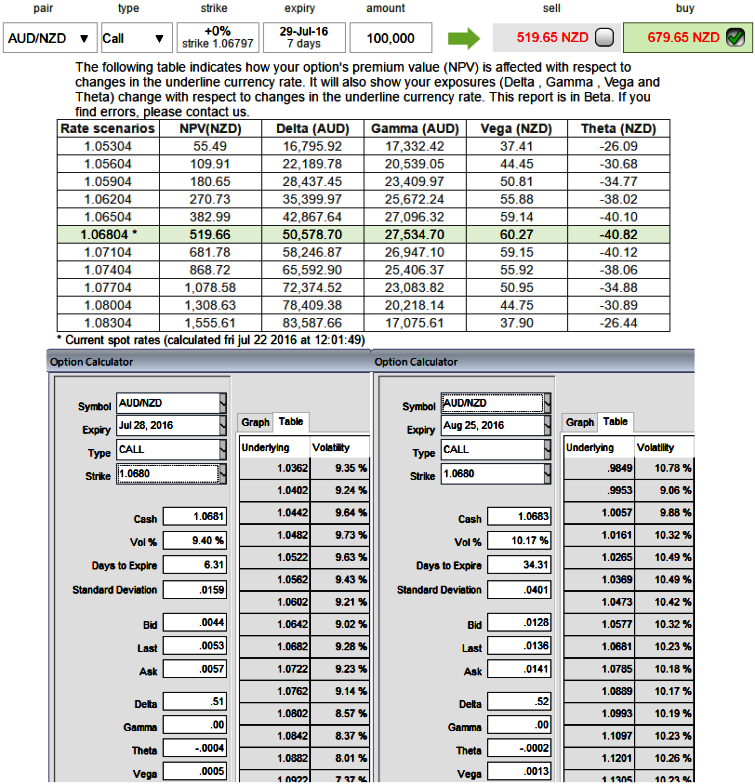

Please be noted that the 1w ATM premiums are trading 30.8%% more than NPV, while implied volatility of these ATM 1W contracts are just creeping above at 9.4%.

Hence, don’t you consider this as a considerable disparity between premiums and IVs that keeps us eyeing on writing such expensive options with shorter expiries.

During such scenarios, option writing techniques that the sophisticated investors can utilize to enhance the profitability regardless of market movement in any direction.

It first outlines a strategy for selling options short, using tables and charts to illustrate each step, and then builds a three-legged model for using popular options tools when purchasing stocks.

Additional features include techniques for extending a position or writing “up” a position, a valuable listing of available online option tools, and steps for taking advantage of market volatility.

A seller wants IV to fall so the premium falls which is evident in this AUDNZD case. You should also note short-dated options are less sensitive to IVs.

Low IV implies the market thinks the price would not move much in shorter run and so that it is beneficial for option writers.

Technically, the trend in this pair sees a stiff resistance at 1.0750 that has been hampering the previous bull swings momentum after shooting star pattern while major trend experience sheer weakness, for more reading on technicals please follow below link.

As a result of above observations, we conclude capitalizing on potential downswings and hence, those who compare the difference in options premiums with implied volatilities, think over the hedging cost for downside risks could be made economical while shorting such options, use of shorts of expensive option premiums to deploy in any hedging strategy is a smart idea.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics