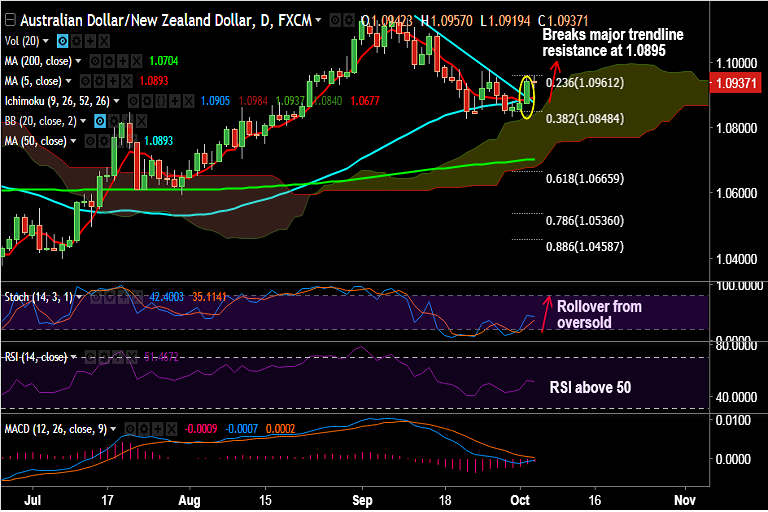

- AUD/NZD breaks past major resistance at 1.0895 on Tuesday's trade, spikes past 1.09 handle.

- Aussie trades marginally lower against Kiwi after AIG services index missed expectations.

- Data released earlier today showed Australia September AIG services index decreased to 52.1 vs previous 53.

- The pair is trading in a narrow range on the day, consolidating previous session gains.

- 20-DMA at 1.0954 is strong resistance, pair struggling to break above.

- Technical indicators on intraday charts have turned slightly bullish, Stochs have rolled over from oversold levels and RSI is above 50.

- That said, techs on weekly charts are still bearish. Stiff resistance lies at 1.1155 (major trendline), only decisive break above could see further upside.

Support levels - 1.09, 1.0894 (converged 50&5-DMA), 1.0848 (38.2% Fib retrace of 1.0370 to 1.1143 rise)

Resistance levels - 1.0954 (20-DMA), 1.0961 (23.6% Fib), 1.0978 (Sept 26 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-NZD-finds-stiff-resistance-at-10895-further-upside-only-on-break-above-930822) has hit TP1.

Recommendation: Book partial profits. Watchout for break above 20-DMA for further upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 60.8118 (Neutral), while Hourly NZD Spot Index was at -152.137 (Bearish) at 0400 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest