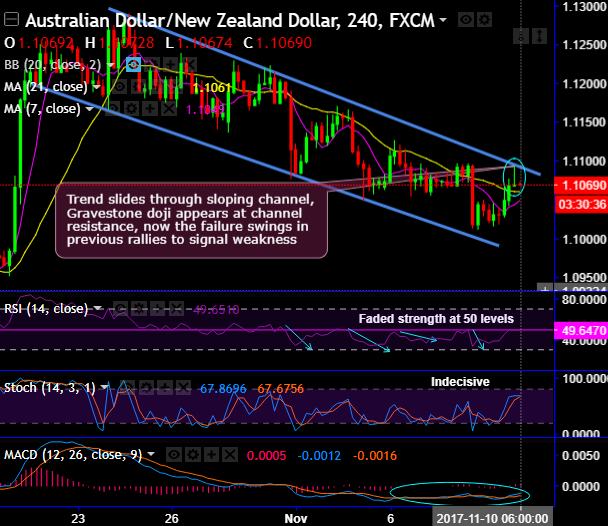

Short-term trend of this pair slides through sloping channel.

Gravestone Doji appears exactly at channel resistance (at 1.1069 levels), the failure swings at peaks of previous rallies rejected at channel resistance signal weakness (refer highs of previous trading session candle, 4H chart).

As a result, this bearish pattern encourages the resumption of slumps in short-term trend, but the major trend still drifts into the consolidation phase.

After three consecutive days’ of upswings in AUDNZD, the weakness is now evident.

The next stiff resistance is observed at 1.1090 – 1.11 levels, and the strong support zone at 1.1060 levels.

On the flips side, the major trend has been stuck in the long-lasting range (refer monthly charts), the current prices spike above EMAs but attempt to slide back in this range as it reaches near range resistance.

RSI and stochastic curves have constantly shown a faded strength at 65 levels. While stochastic curve on this timeframe signals overbought pressures.

Overall, the resumption of the major downtrend is on the table, even if you any abrupt upswings, that shouldn’t be deemed as panicky sentiment.

Trade tips:

Contemplating both short term and long term technicals, we recommended a limited loss but certain yields structure via double-no-touch optionality in next 1-month, AUDNZD 1m DNT with 1.1289/1.0785 strikes – but we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 56 levels (which is bullish), while hourly NZD spot index was at shy above -17 (which is neutral) while articulating (at 06:45 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate