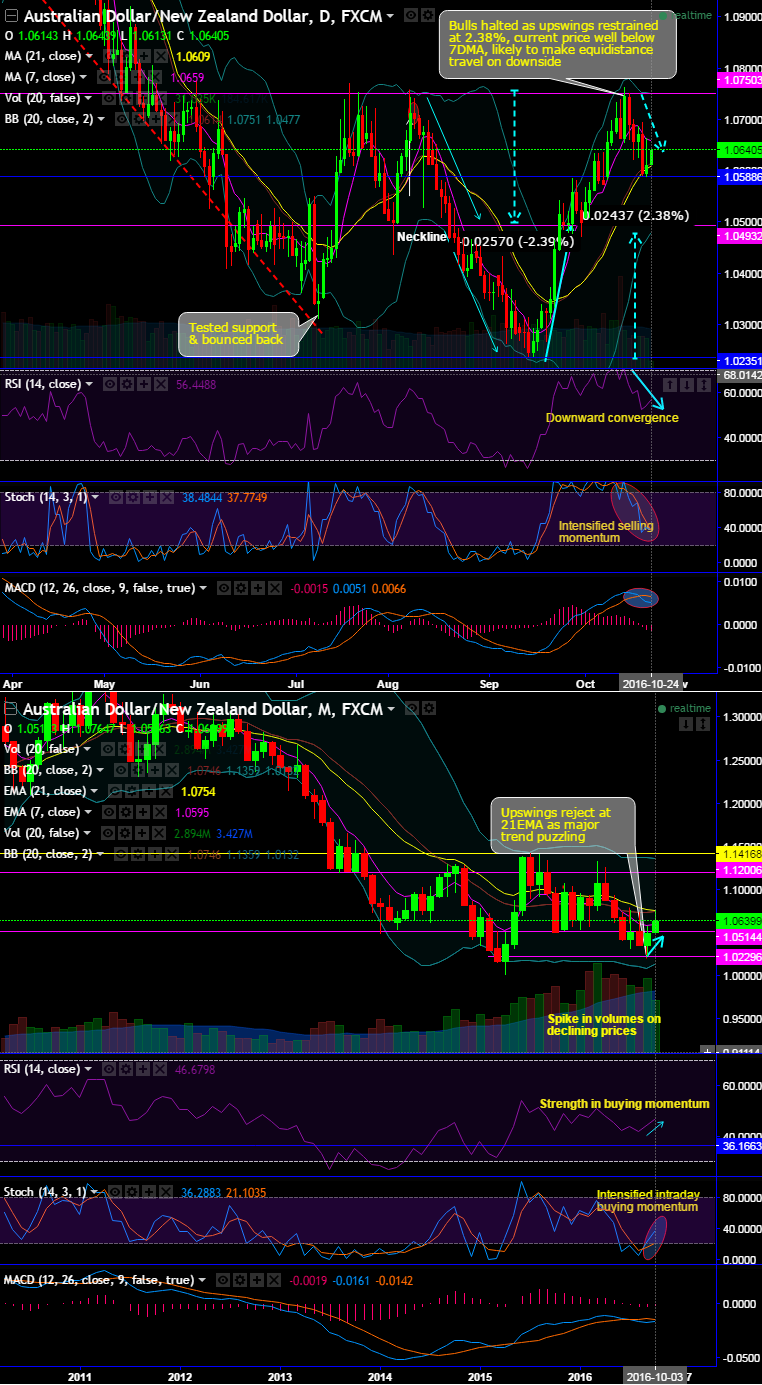

On the daily chart, amid the last week’s bearish journey, bulls taking support at 1.0608 levels (i.e. 21DMA) & attempting to drag Friday’s gains.

But in converse, the bulls have halted as upswings restrained at 2.38%, the current price well below 7DMA, likely to make equidistance travel on the downside.

Pivot points: 1.0705, 1.0493 and 1.0235 levels.

Although Aussie dollar has been recovering its price losses against Kiwi dollar, bears interest to hit the lows of 1.0493 cannot be ruled out (whenever the pivot points breach or reject 2.38% distance).

One can observe the distance (2.39%) once bears broke down below the neckline of the double top, they have traveled equidistance (2.38%) and taken support exactly at that level.

The current prices have slid below 7DMA, while MACD evidences bearish crossover, so we foresee bearish swings to be prolonged.

Both leading indicators (RSI & stochastic) are signalling buying sentiments on the monthly graph. RSI evidences the positive convergence with the ongoing price bounces that signifies the strength in bullish momentum, (currently, RSI trending above 46 levels).

While, stochastic curve right from 20 levels which is oversold zone has been evidencing %K crossover on the monthly chart, but the bearish intensity on daily terms.

If next week’s monetary policy from RBA doesn’t surprise by any easing, then prevailing bull swing may creep up in short term but for long term trend reversal, we seek proper clarity going forward.

The leading oscillators have been decisive on this time frame.

The long-term investors may have to wait for better clarity for reversals.

Well, having said that we wrap up with the concluding note, short-term bulls can speculate this pair whereas long-term investors have to wait for safe play. Buying one touch binaries at every dip would add leveraging impact on daily traders’ portfolios.