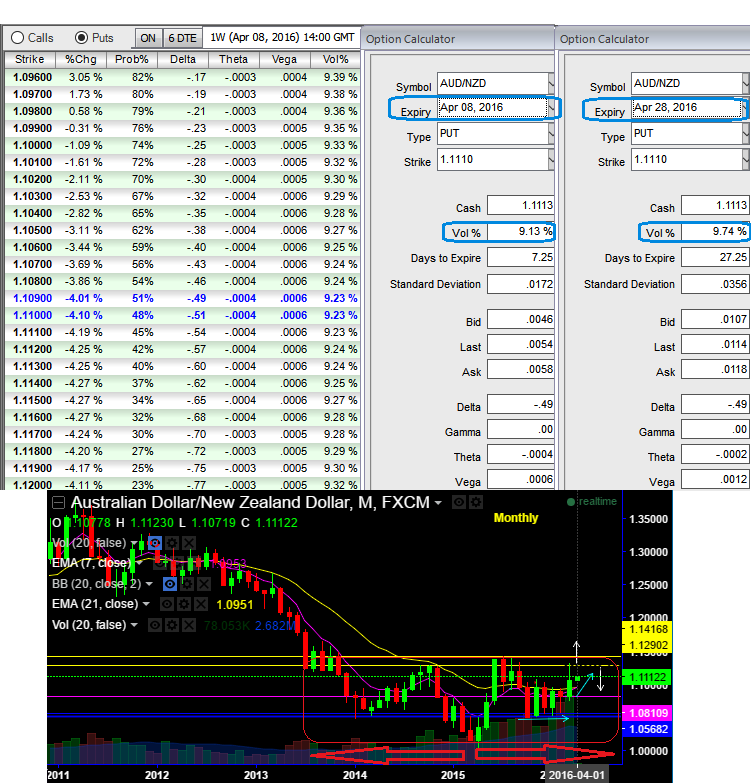

ATM IVs of 1W expiries are at 9.13%, and 9.74% for 1M tenor.

Technically, we are seeing stiff resistances at 1.1121 and 1.1290 levels.

You evaluate the IVs of 1W expiries with different ITM strikes and their probability numbers, and the prevailing bullish swings may not be having the same momentum in rallies as we are seeing it right now.

The pair has been struggling since RBA's hints of easing on Australia's improved economic conditions, growing at steady pace despite global economic struggle.

And most notably in contrast, the recent surprising rate cuts package from RBNZ by 25 bps has also caused more expectation in further easing cycle in 2016, this would bring in more upside potential of this APAC pair in long run.

Well, overall this bull run may prolong in long term but "1.1290" has been the pivotal level for more clarity as it held stiff below 1.1290 from almost last two and half years.

If IV is high, it means the market thinks the price has potential for large movement in either direction. Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

You observe there wouldn't be no drastic difference between 1W and 1M implied volatilities (9.13% and 9.74%).

Most importantly, sensitivity table indicates that the underlying spot rates are most likely to drift towards lower strikes, which means that higher chances forward rates moving below ITM strikes as there is no drastic change in IVs.

Well, contemplating this IVs, & technical observations and sensitivity scenarios, the current rallies may likely to slow down its momentum or even drift below lower spot levels which is conducive for options writers.

Hence, we recommend initiating longs in 1M ATM +0.51 delta call, 1 lot of 1M 2W (1%) OTM +0.38 delta call and simultaneously short 1 lot of deep OTM call (2%) with comparatively shorter expiry (preferably 1W) in the ratio of 2:1.

The higher strike short calls because IV is reducing and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost.

Please note seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IVs, so in this strategy we have short position suitable to both above conditions.