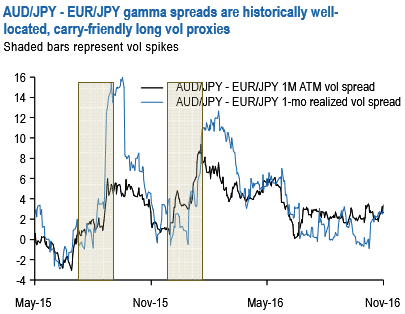

AUD/JPY vs. EUR/JPY gamma spreads: Standalone cross-yen gamma may be a tough buy at current levels, but AUDJPY vs. EURJPY 1M gamma spreads are far better priced and have historically done a fair job of proxy-hedging global vol eruptions (see above chart for gamma spread expression).

The key to the spread is the use of EURJPY as the financing leg, which should behave more like a low-beta non-dollar cross in this instance despite its cross-yen moniker, as the pair remains trapped between two similarly situated central banks running up against comparable techno-political constraints vis-a-vis additional QE, and with similar sensitivities of the individual EUR and JPY legs to the yesterday’s US election surprise.

Short EURJPY vol is one of our highest conviction views and for those on board, opens up other opportunities to set-up zero-cost conditional hedges by selling EURJPY options as the underlying spot FX drifts into non-directional trend from last 4 and odd months.

For instance, shorting 1M 112/109 puts spreads and 1M 118/121 call spreads in EURJPY (i.e. a 109-112-118-121 condor, one of our open trade recommendations) can nearly costless finance the purchase of 1M 102 strike USD puts/JPY calls or 1M 1.13 strike EUR calls/USD puts at current market.

We label such long/short structures ‘conditional hedges’ because the purchased option legs kick in handsomely the event of the Trump victory, without creating an offsetting liability on EURJPY option shorts (if we are right on the assumption that the cross continues to trade sideways such that EURJPY options expire worthless), all options likely expire out of the money and leave no P/L exposure to that market state.

The maximum possible loss for a long condor option strategy is equal to the initial debit taken when entering the trade. It happens when the underlying spot price on expiration date is at or below the lowest strike price and also occurs when the spot price is at or above the highest strike price of all the options involved.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One