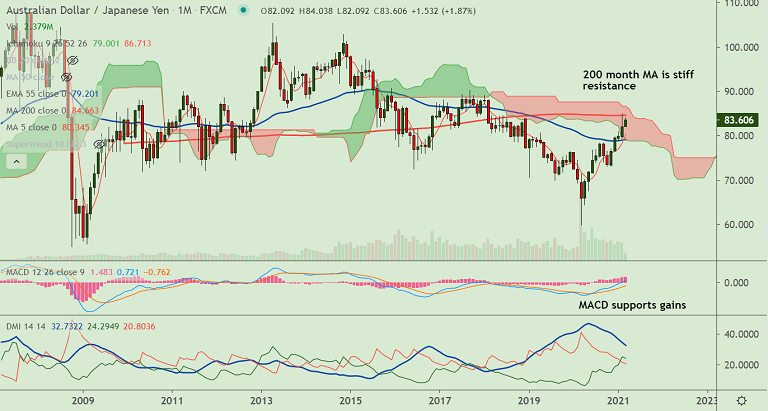

AUD/JPY chart - Trading View

AUD/JPY was extending bull run for the 3rd straight week, outlook for the pair remains bullish.

Strong Aussie jobs data and upbeat sentiment provides additional support to the pair.

Australian Unemployment Rate dropped in February to 5.8% which was better than the expected 6.3%, down from a peak of 7.5% in July.

Australia's February Employment change arrived at +88.7K a huge beat on the expected +30K.

Price action has edged above 200 monthly moving average and any close above will buoy bulls in the pair.

Volatility is high as evidenced by widening Bollinger bands, momentum is strongly bullish.

Major resistance are seen at 86.83 (88.6% Fib) ahead of 90.30 (2017 high). Supports align at 84.67 (200 month MA) and then 86.69 (20-DMA).