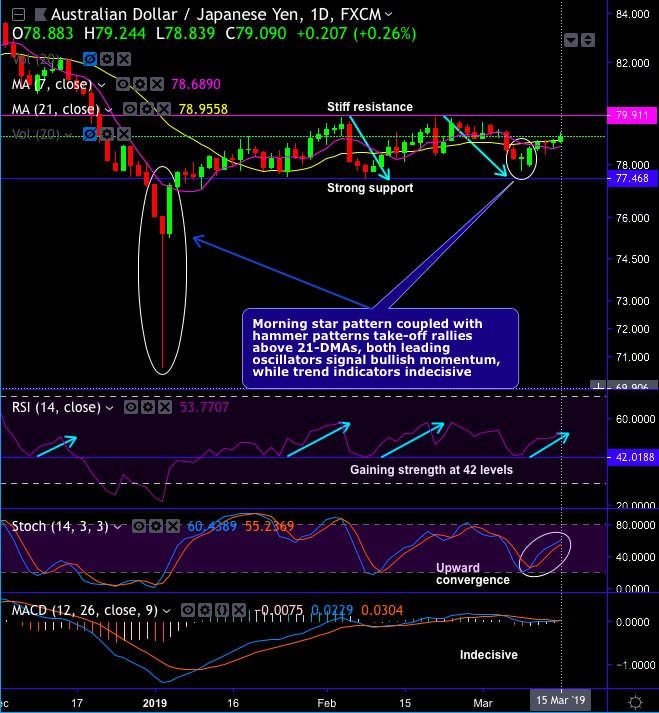

AUDJPY bulls, in the minor trend, have been gaining traction, attempt to bounce back as the pair breaks-out resistance of 21-DMA levels. For now, the current price remains well above DMAs but attempting to head for yet another resistance of 79.102 levels, further rallies seem to be most likely as both RSI and stochastic indicates the buying momentum.

We reiterate bulls in the short-term are imminent upon ‘morning star’ pattern that is coupled with hammer candles at 78.614 levels (refer daily chart).

Hammers have occurred at 75.414 and 78.289 levels, where strong support is seen at 77.468 and the stiff resistance is at 79.092 and 79.911 levels.

While the major trend has been consolidating, bearish engulfing pattern drags price slumps below 7EMAs, while hammer pops-up at 79.160 levels, attempts to counter major downtrend, strong support is observed at 72.007 levels but both trend indicators (EMA & MACD crossovers) signal weakness, while both RSI & stochastic curves signal mild bullish momentum (refer monthly chart).

Trade tips: On trading grounds, at spot reference: 79.111 levels, it is wise to trade one-touch calls, with upper strikes at 79.402 levels.

Alternatively, on hedging grounds, we advocate initiating longs in AUDJPY futures contracts of Mar’19 delivery as further upside risks are foreseen and simultaneously, shorts in futures of May’19 delivery for the major downtrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -3 levels (which is neutral), while hourly JPY spot index was at -151 (bearish) while articulating (at 05:51 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex