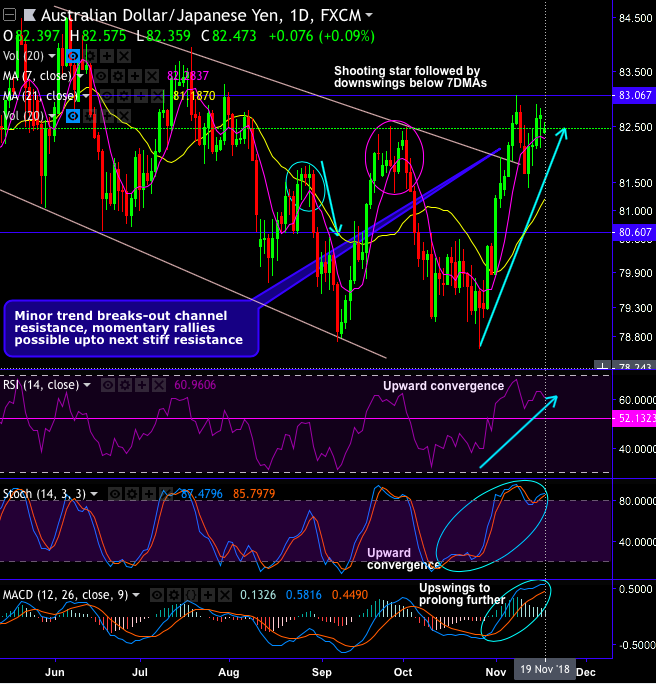

AUDJPY minor trend has been sliding through sloping channel so far, on the flip side, bulls in the short-term attempt to bounce back as it breaks-out channel resistance at 81.799 levels. For now, the current price remains well above DMAs, further rallies seem to be most likely as both RSI and stochastic indicates the buying momentum, while MACD has also shown bullish crossover remaining in bearish trajectory (refer daily chart).

While the major trend has been consolidating, frequent shooting star patterns have occurred in the recent months that evidence failure swings at 21-EMAs, consequently, bearish engulfing pattern drags price slumps below 7EMAs (refer monthly chart).

Amid momentary rallies upto next stiff resistance (resistance being 83.067 levels), consolidation phase of this pair seems to be robust as both leading oscillators indicate intensified bullish momentum (both RSI & stochastic curves show upward convergence).

Trade tips: On trading grounds, at spot reference: 82.494 levels, it is wise to trade boundary strikes, with upper strikes at 82.898 and lower strikes at 82.2890 levels.

Alternatively, on hedging grounds, we continue to advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 78.500 levels in the medium-run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 121 levels (which is bullish), while hourly JPY spot index was at 24 (mildly bullish) while articulating (at 08:07 GMT). For more details on the index, please refer below weblink: