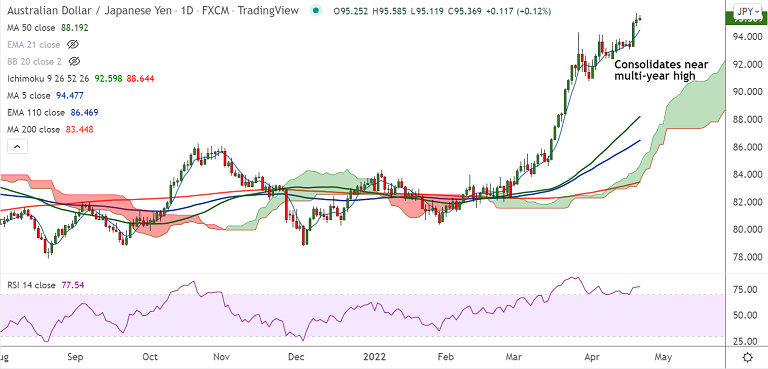

Chart - Courtesy Trading View

AUD/JPY was trading 0.19% higher on the day at 95.43 at around 08:40 GMT. The pair trades at levels unseen since June 2015, further upside on cards.

Hawkish shift in the forward guidance by the Reserve Bank of Australia (RBA), keeps the sentiment around the AUD buoyed.

Cautious seen in the market ahead of the speeches by the key global central bankers, including Fed Chair Jerome Powell to confirm the recently increased hawkishness.

In its latest report published on Thursday, the Bank of Japan (BOJ) said that Japan's financial system to remain 'highly robust' even if resurgence of covid, rise in U.S. Long-term rates hit economy, markets.

Technical analysis shows major and minor trend for the pair are strongly bullish. Volatility is high and rising. Scope for further upside.

Support levels - 94.49 (5-DMA), 93.06 (20-DMA)

Resistance levels - 96.99 (June 2015 high), 97.30 (May 2015 high)

Summary: AUD/JPY poised for further gains. Little resistance seen till next bull target at 97 mark.